Simple and intelligently delivered

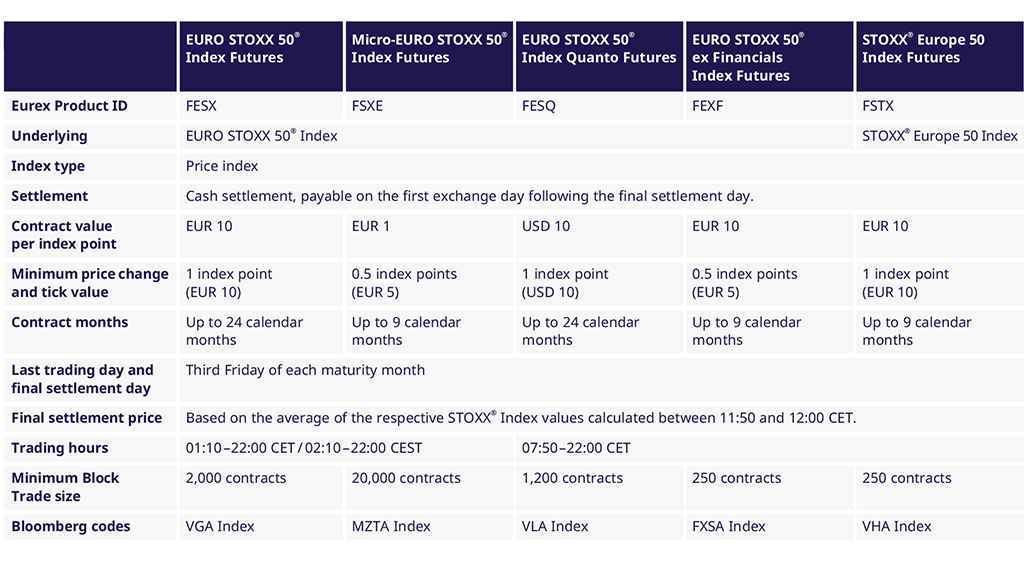

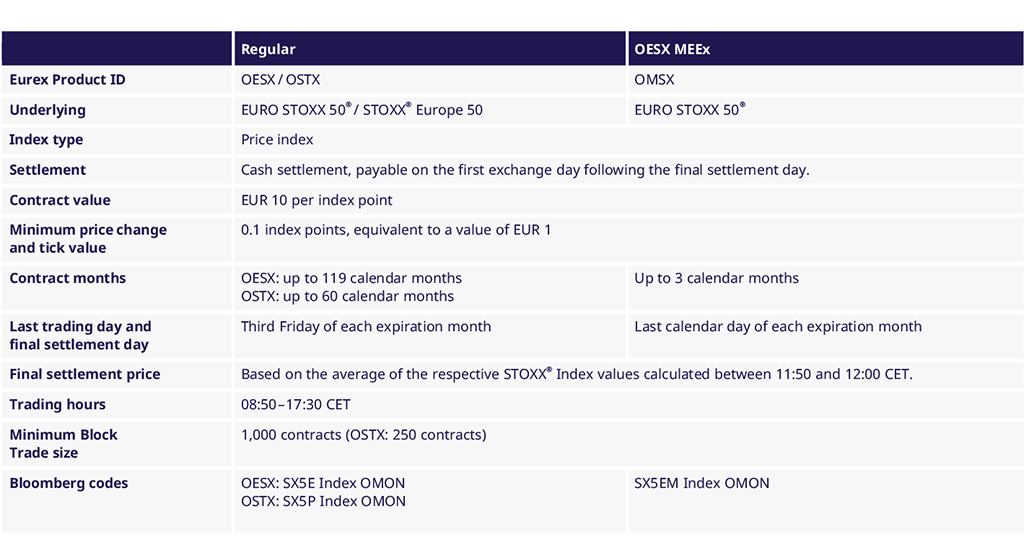

EURO STOXX 50® Index derivatives are ideally suited for hedging and enhancing the performance of equity portfolios on both on-exchange and OTC markets. Futures and options on the EURO STOXX 50® Index are the most actively traded EUR-denominated equity index derivatives at Eurex.

The EURO STOXX 50® index comprises the 50 leading blue-chip stocks in the Eurozone countries. The index weighting is based on a free-float market capitalization, with a maximum weighting of ten percent weighting for each constituent. The free-float market capitalization of the EURO STOXX 50® index accounts for approximately 60 percent of the capitalization of the entire Eurozone.

Benefit from reliable trading volumes, including the successful EURO STOXX 50® Index, which comprises the largest companies in the euro area.

EURO STOXX 50® Index derivatives: Traded Contracts and Open Interest (in Millions)