Order-to-Trade Ratio

Eurex has recalibrated the Order-to-Trade Ratio (OTR) with effect from 1 January 2021. Main changes compared to the OTR regime until December 2020 are the newly calibrated parameters as well as the provision of intraday periods.

The limits for the volume-based OTR are set on the ratio between volume of all order-entries (ordered volume) to the trading volume per product and per day generated by orders and quotes sent by the participants to T7. The limits for the transaction-based OTR are set on the ratio between number of all order entries (number of orders) to the number of trades per product and per day generated by orders and quotes sent by the participants to T7. For the calculation of the ordered volume (respectively the number of orders), all types of orders and/or quotes are considered. This includes any/all of the following: add, modify and delete. For the calculation of the traded volume (number of trades), all executions are taken into account. Please note, the aforementioned metrics are calculated per trading day, product and per participant.

The limits are defined based on the product type. For some products with a different behaviour, the limits are modified by a product specific factor. In case a participant fulfilled the Minimum Quotation Requirements, the limits will be increased considering the quotation performance.

At the end of a day, if the value of an OTR for a particular product for a particular participant is greater than a pre-defined limit, such instance is considered a violation. A violation may trigger sanctions against the participant.

The TR100 report is published on a daily basis. Intraday versions are available as well. With the intraday reports, Participants have access to preliminary values of the OTRs as well as the respective limits during the day. The intraday versions of the report are published every 30 minutes, starting at 1:30 CET and ending at 21:30 CET (intraday versions of OTR reports for T7 FX are published from 0:30 to 22:30 CET). The final conclusion on whether the OTR is violated can be drawn only at the end of a day.

The volume-based OTR is calculated using the following equation:

OTR vol = [ ordered volume ] / [ traded volume ] - 1

The ordered volume is the sum of:

- the number of contracts generated by orders and quotes that are accepted by the matching engine and entered in the order book and

- the number of contracts that the Participant deletes from the matching engine and thus have not been executed.

A modify of an order or quote is treated as a "delete" followed by an "add". Thus, the original order and the new order will both be counted towards the ordered volume. This process applies regardless of which attribute of the order and/or quote is changed. An IOC order is treated like an order submission, while the unexecuted portion will be treated like an order deletion.

If an order or a quote is fully or partially deleted by the Self-Match Prevention (SMP) functionality then the ordered volume is increased both on the buy- and the sell-side only by the number of the deleted contracts.

The traded volume is the executed volume in the order book. If the traded volume is smaller than the volume-based minimum value, it is replaced with the volume-based minimum value.

The limit of the volume-based OTR considers the product type, the product. For participants fulfilling the minimum quotation requirements we apply higher and dynamic limits. The dynamic limits are depending on the quote performance (i.e. number of instruments and time with quotes in relation to the minimum requirements), the spread quality, the average quote size, as well as quotation during stressed market conditions.

Please find below a concept paper describing the calculation (including an example) in detail.

The transaction-based OTR is calculated using the following equation:

OTR count = [ number of orders ] / [ number of trades ] - 1

The number of orders is the sum of:

- the number orders and quotes that are accepted by the matching engine and entered in the order book and

- the number of orders the Participant deletes from the matching engine and thus have not been executed.

A modify of an order or quote is treated as a "delete" followed by an "add". Thus, the original order and the new order will both be counted towards the number of orders. This process applies regardless of which attribute of the order and/or quote is changed. An IOC order is treated like an order submission, while the unexecuted portion will be treated like an order deletion.

If an order or a quote is fully or partially deleted by the Self-Match Prevention (SMP) functionality then the number of orders is increased both on the buy- and the sell-side only by the number of involved orders.

The number of trades is the number of executions in the order book. If the number of trades is smaller than the transaction-based minimum value, it is replaced with the transaction-based minimum value.

The limit of the transaction-based OTR considers the product type, and the product. For participants fulfilling the minimum quotation requirements we apply higher and dynamic limits. The dynamic limits are depending on the quote performance (i.e. number of instruments and time with quotes in relation to the minimum requirements), the spread quality as well as quotation during stressed market conditions.

Please find below a concept paper describing the calculation (including an example) in detail.

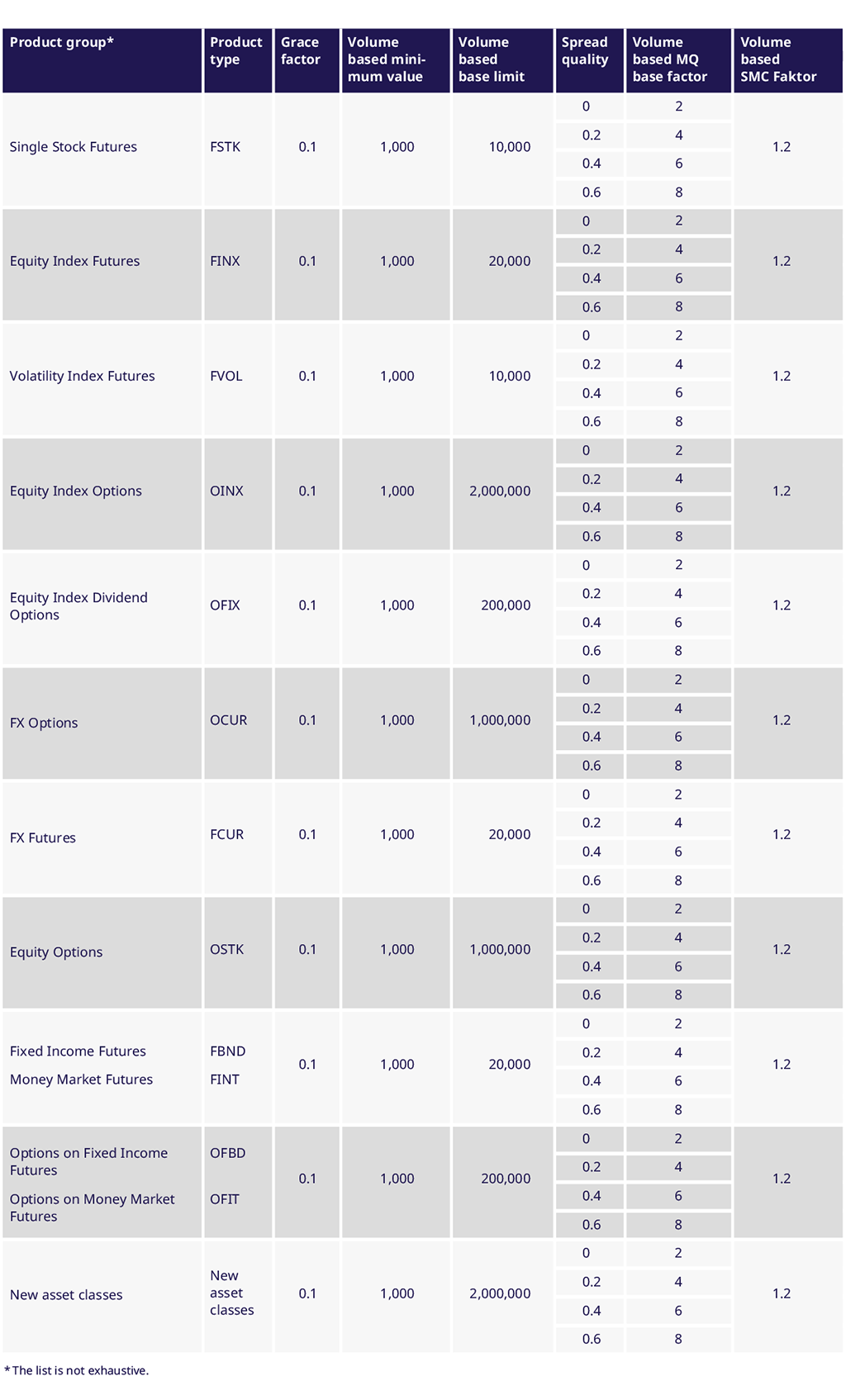

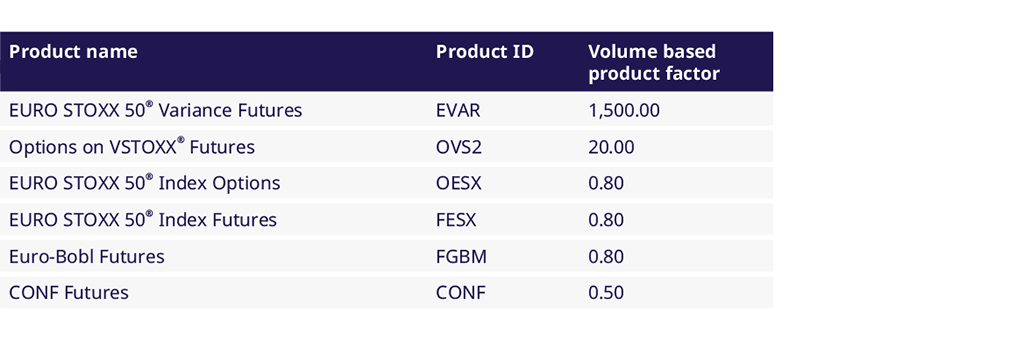

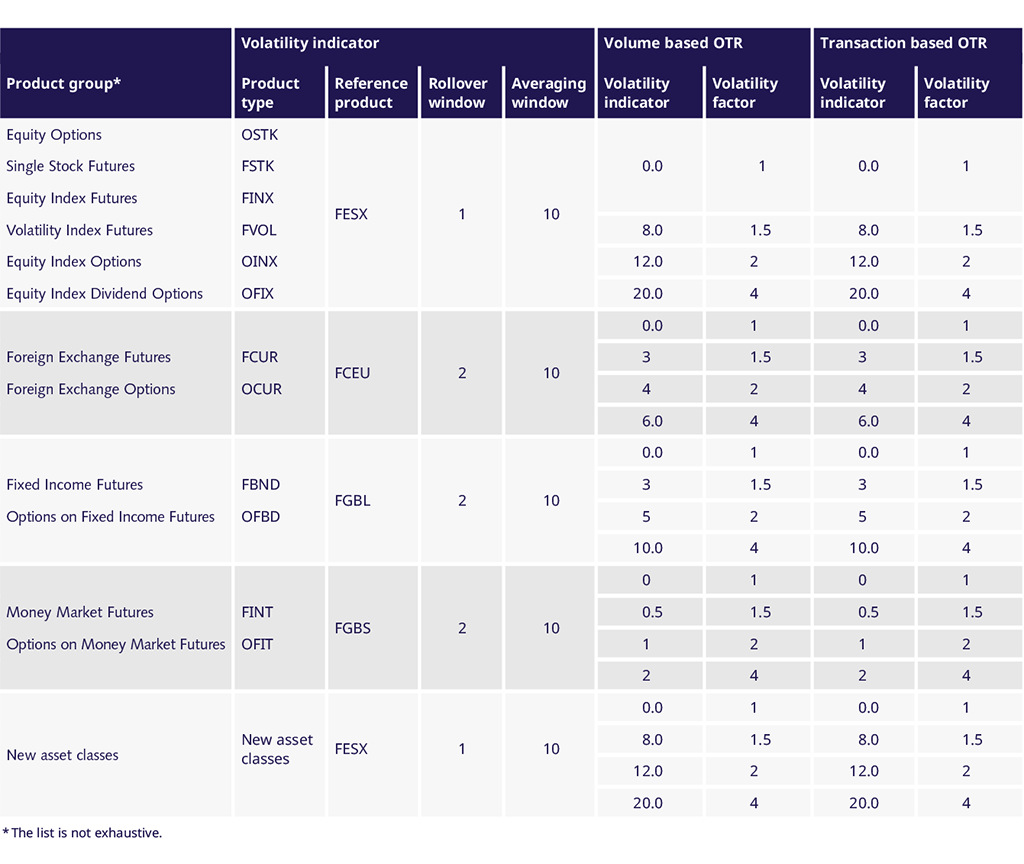

The following tables show the parameters used to calculate the volume based OTR.

Please note: The limit is based on the product type of the product.

If a product is not included in the table, i.e. has no product factor assigned, the default value of 1.00 is applied.

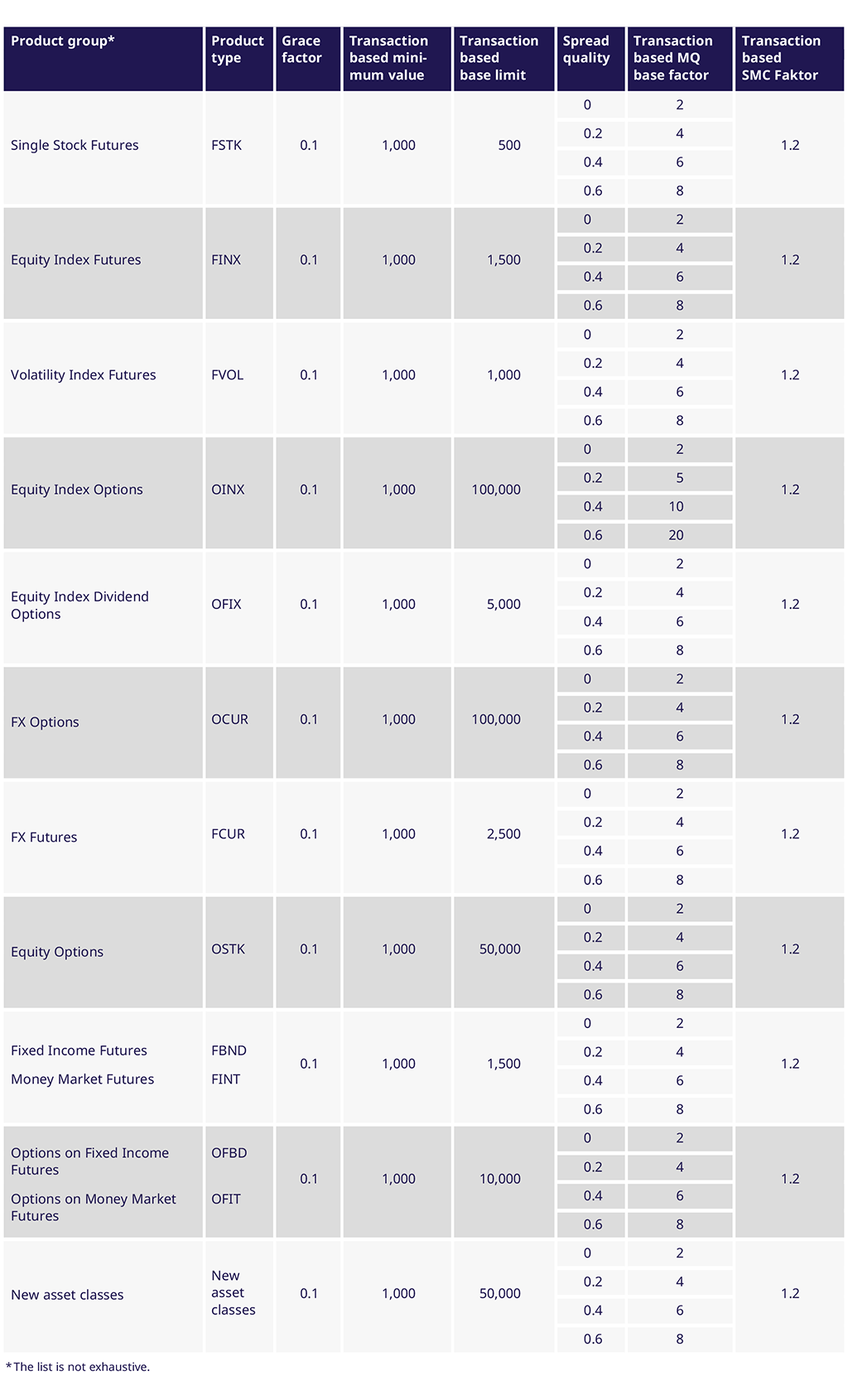

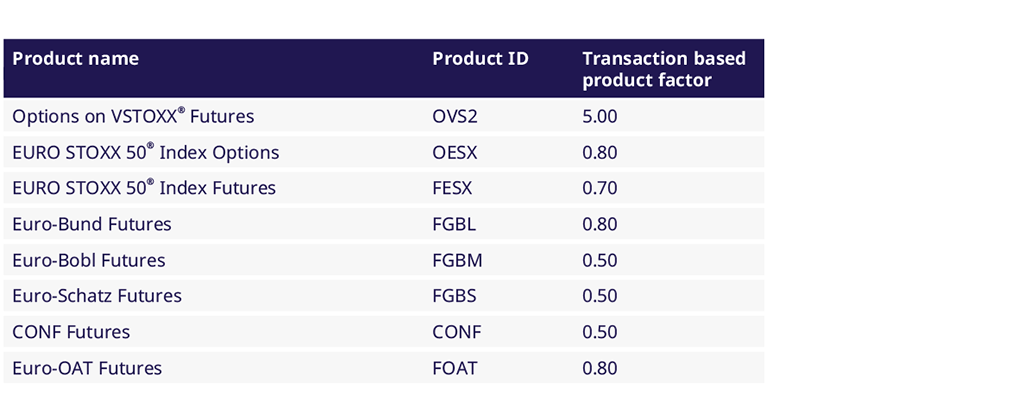

The following tables show the parameters used to calculate the transaction based OTR.

Please note: The limit is based on the product type of the product.

If a product is not included in the table, i.e. has no product factor assigned, the default value of 1.00 is applied.

The following reports will be available for the Participants on the Common Report Engine:

- CB069 (Transaction Report): Report is generated on a daily basis. Additionally, intraday versions of the report are available every 30 minutes.

- TR100 (Order To Trade Ratio Report): Report is generated on a daily basis. Additionally, intraday versions of the report are available every 30 minutes.

- TR103 (Daily Order to Trade Ratio Parameter): Report is generated on a daily basis.

- TR105 (Minimum Quotation Requirement): Report is generated on a daily basis.

- TR106 (Order to Trade Ratio Detailed Transaction Report): Report is generated on a daily basis.

Under further information you can find a concept paper describing the calculation (including an example) in detail.