Key Benefits

- Price transparency

Compelling alternative to the OTC market due to its price transparency benefits - Liquid benchmark products

More than EUR 6.71 trillion notional volume has been traded since inception - Easy access to Germany

Gain exposure to the top 40 German stocks at a lower contract value - Exchange-traded benefits

Major trading, clearing and risk management functionalities at the exchange help to reduce counterparty risks and increase margin efficiencies - Trading and clearing across all time zones

Extended trading hours creates more trading and hedging opportunities for the market participants across all time zones - Asia, Europe and the U.S.

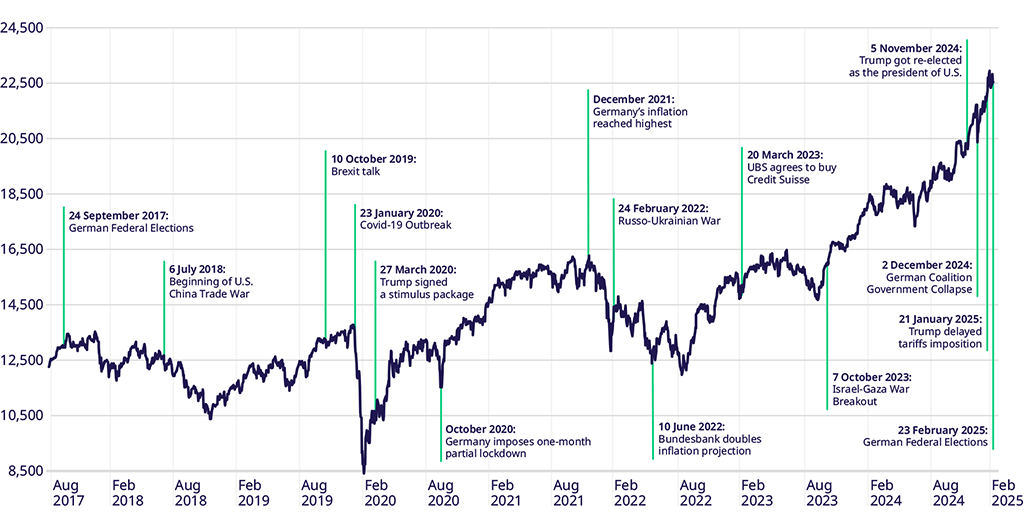

Historical Price Movements

Source: Eurex (updated as of 4 April 2025)

Advantages over ETFs

In nearly every trading scenario, Mini-DAX® futures offer a more cost-efficient way to manage DAX 40® exposure compared to ETFs:

| 1) No Management Fee | Pay no management fee when you trade FDXM futures vs. DAX 40® ETFs |

| 2) Capital Efficiency | Mini-DAX® futures margin is more capital efficient comparing it to the direct investment in DAX 40® ETF's |

| 3) 24/5 Trading Access | Nearly 24/5-access means additional trading and hedging opportunities during events ie. Brexit, German elections |

| 4) Tactical Trading Tool | Short-term strategy based on anticipated market trends |

| 5) Minimal Tracking Error | FDXM futures track the underlying index very accurately |

Advantages over CFDs

Mini-DAX® futures offer a variety of advantages in comparison to CFD’s and warrants on DAX 40® Index:

| 1) Exchange Traded | Mini-DAX® futures trade on a regulated exchange platform (Eurex) with an independent exchange surveillance |

2) Transparent Pricing | Eurex offers transparent trading & clearing services, including a central counterparty system with reduced counterparty risk |

| 3) High Liquidity and Tight Spread | Mini-DAX® futures offer extended liquidity and tightest spreads during full trading hours |