優勢

• 對沖股票、信貸和選擇權投資組合中的風險

• 發現歐洲及歐洲以外波動率指數之間的價差

• 通過添加新的資産類別實現投資組合多元化

• 基于波動性的均值回歸性質,獲取超額收益 alpha

• 實施尾部風險對沖

• 在單個波動性指數水平上交易定向頭寸

• 適用于所有期貨到期日的綜合價差矩陣

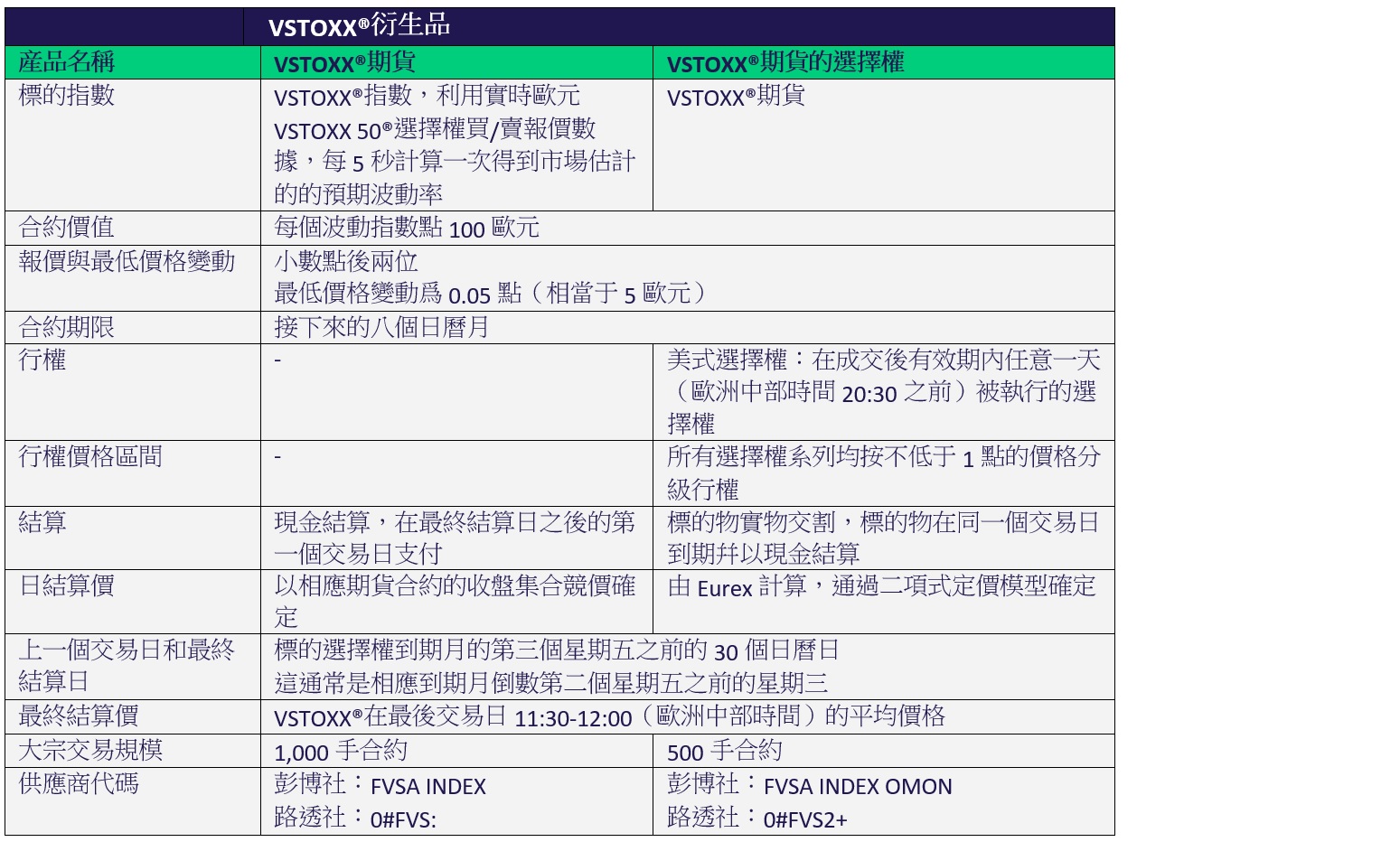

合約規範

清算

VSTOXX®是歐洲期貨交易所清算公司保證金系統(Prisma)的一部分

要充分利用交叉保證金效率,請查閱我們的 Eurex Clearing Prisma手册。要獲得高度準確的假設方案和增量風險計算,請使用我們的雲端保證金估價器。