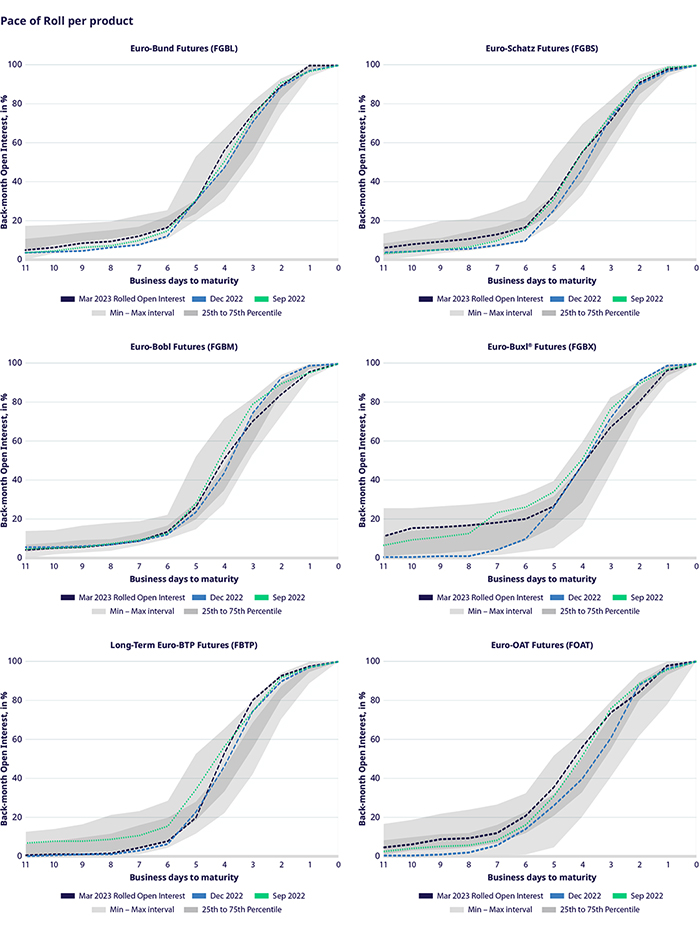

Similar activity to previous rolls with some irritation in the repo market

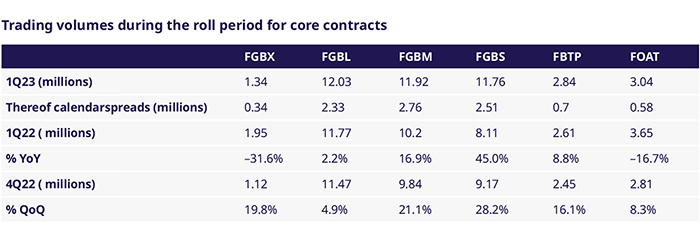

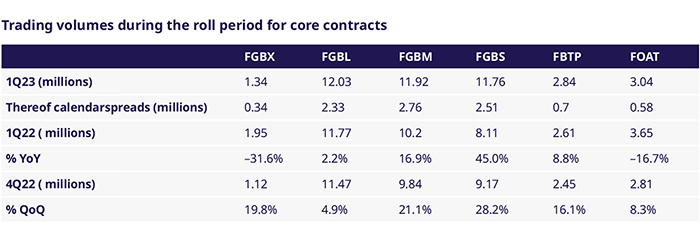

Trading volumes during the roll period (last eight days before expiry)

In addition to the contract roll, we saw significant activity in the outright markets. Aggregated trading volumes across expiries during the roll days grew by 12% YoY for all contracts combined. The highest trading volume increase was observed in the Schatz futures with +45% YoY.

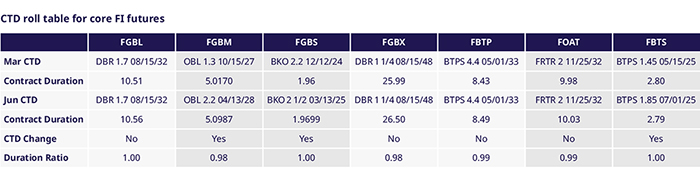

In terms of deliveries, Buxl (with 9k) saw a higher number of contracts being delivered, up from 1k in December, while Bund saw a lower number of contracts delivered at 8k, down from 11k in the last quarter. In Bobls, participants increased the number of contracts going to delivery to 73k, up from 11k in December. The deliveries for short term BTP futures stood at 14k contracts and deliveries for total BTP futures occurred across three bonds. For more information on the delivery, please see here.

Calendar Spreads decreased slightly during the roll