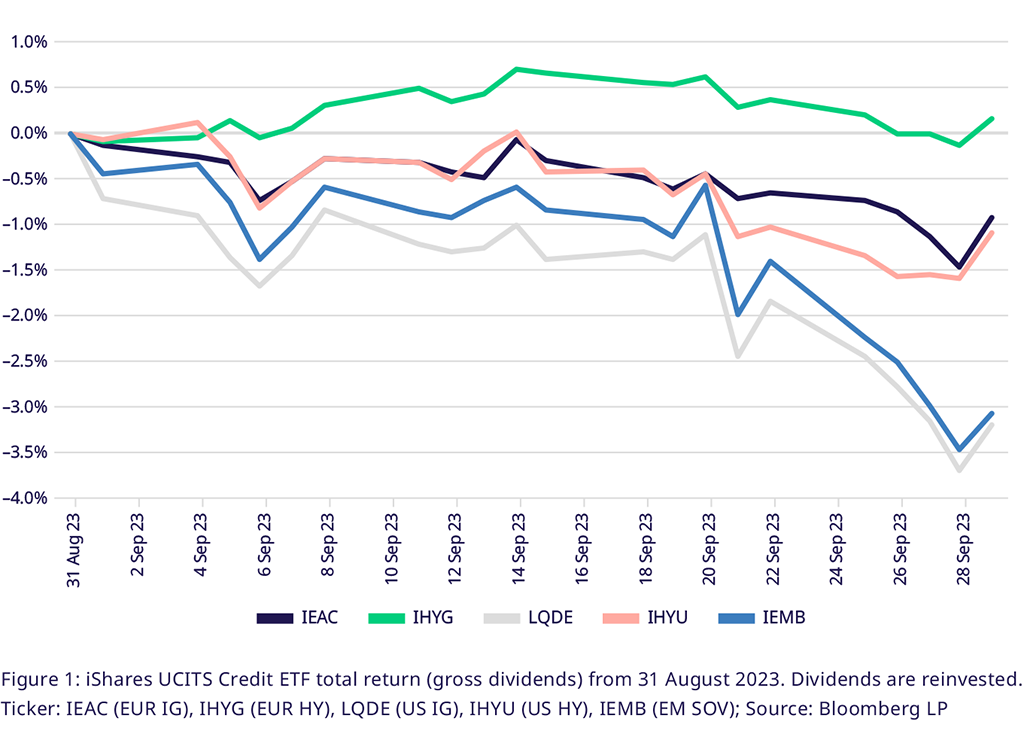

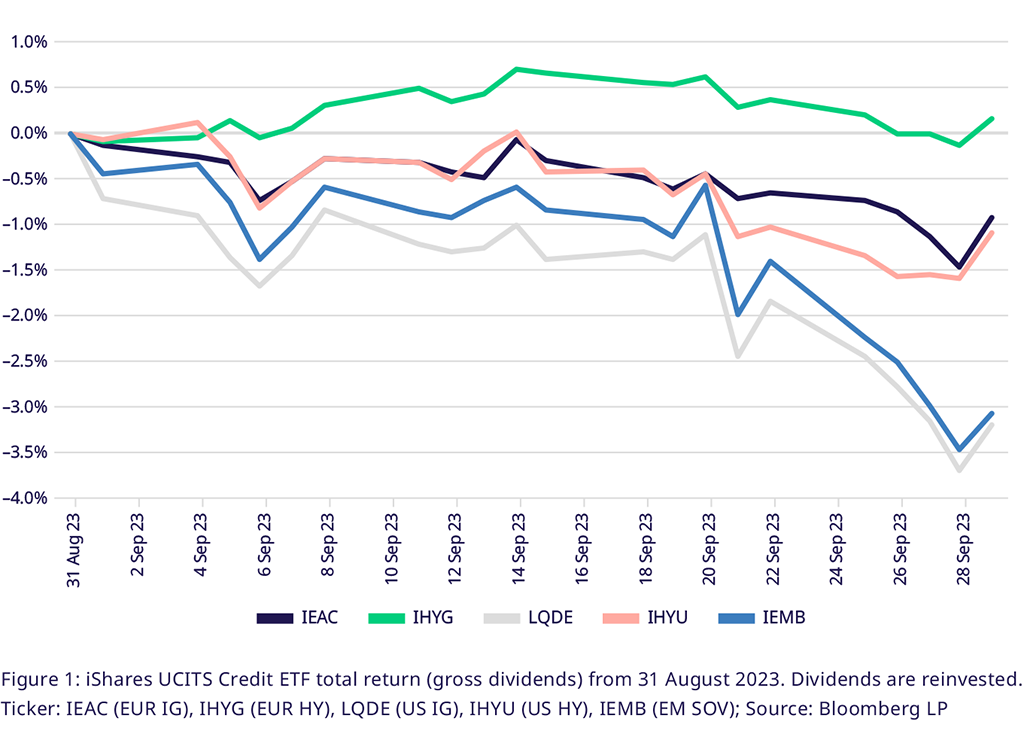

Government bond yield curve's bear steepening main driver behind negative returns for Credit UCITS ETFs. IEMB, LQDE -3%, IHYU -1.2%, IEAC -0.9%, IHYG flat.

Even though total returns from carry did provide some cushion, iShares credit UCITS ETFs were broadly negative. Both in the US and Europe, the main drivers were rising government bond yields, which rose more on the long end than the short end in a consistent move throughout the month. US 2yr yields, that benchmark IHYU, rose 36bps, while the 10yr rose 46bps. Consequently, long duration names were hit the hardest. IEMB had the worst performance throughout the month, with negative 3.19% in total return, followed by IEMB with -3.07%, as carry outweighed widening spreads in EM sovereign credit. Similarly, IHYU was protected by its carry, for a total return of -1.09%. In Europe, the benchmark German curve bear-steepened similarly, with the 2yr rising 24bps, the 10yr climbing 30bps, while spreads declined. IEAC was negative 0.91% over the month, while IHYG had a total return of 0.17%.

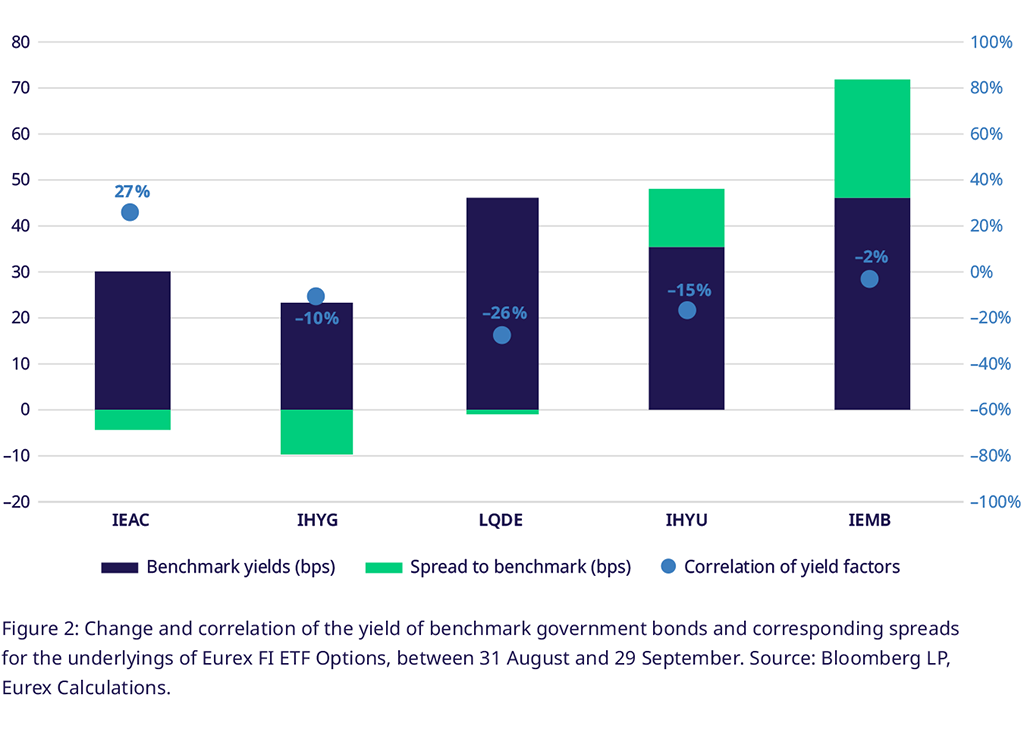

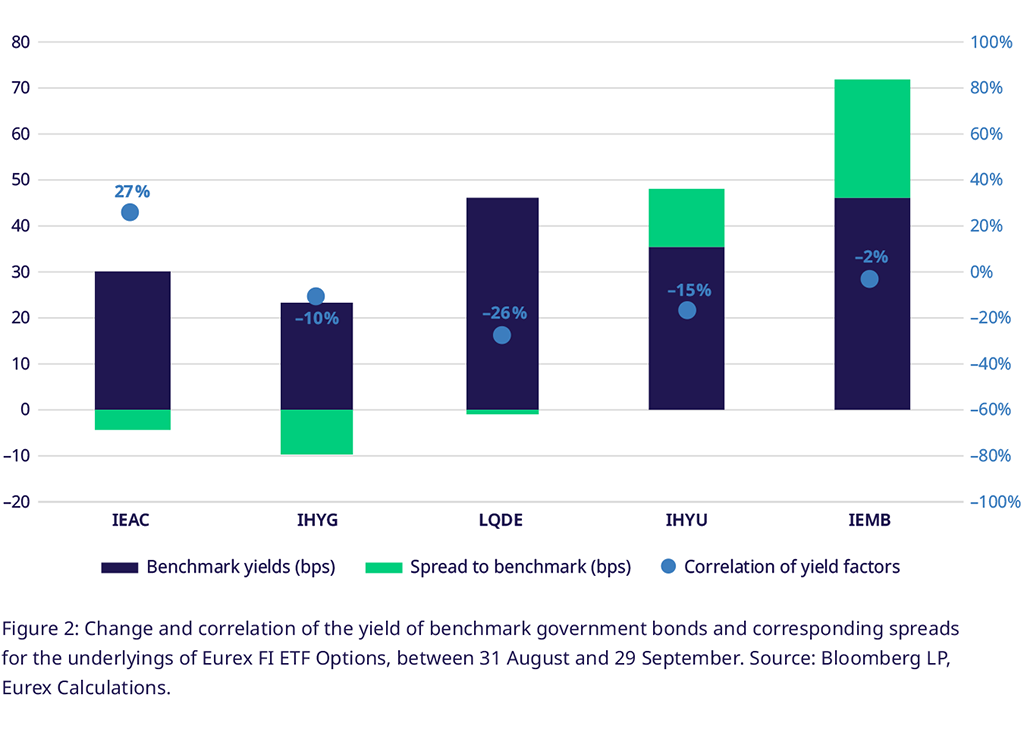

EUR Spreads tighten, while USD quality is preferred over risk. EUR premium declines 20bps for IHYG vs IHYU.

Spreads of USD-denominated risky bonds climbed, with emerging market sovereign credit being hit the hardest. IEMB saw spreads widen by 26bps to 413bps, followed by IHYU with 13bps. Conversely, higher quality USD IG spreads stayed flat on average, as the spread to benchmark for LQDE declined 1bps. In Europe, we saw the opposite play out, as risk was preferred over quality. Spreads of IHYG declined 10bps, counteracting part of the move in benchmark yields. For high quality EUR corporate bonds held in IEAC, spreads only declined 4bps on average. Overall, European credit risk is still priced higher than for the US names. IEAC spreads (172bps) ended the month 27bps higher than for LQDE (146bps), while the difference between IHYG (485bps) and IHYU (362bps) spreads decreased 20bps to 123bps.

USD Credit Spreads rich versus 5yr and 1yr average, cheap for EUR Credit names and IEMB.

Spreads of Credit ETFs vs. the 12-month historical average shows that all names ended the month slightly rich, following the recovery from the spikes induced by the Ukraine war. Richness was most pronounced for LQDE, which had spreads 1.2 standard deviations above the 12-month average, putting the name in rich, but not overbought territory. Looking at a longer term 5-year horizon, we observed that all spreads were within one standard deviation of the 5-year average, with European names being cheap while US were in rich territory, with LQDE being the richest.

Short-duration, high yield credit attractive because of break-even cushion against rates moves.

Break-evens, i.e., the yield-to-maturity over the duration of a bond, indicate how much total return is protected from changes in the yield and credit risk curve. High yield ETFs continued to look attractive in this metric, given their low duration and high carry. IHYG and IHYU displayed break-evens of 2.90 and 2.7 meaning a yield increase of roughly 290 (270) bps would be necessary to make total returns for the ETF negative over the next 12 months. This would bring both names to yield levels last seen in the worst days of the covid crisis, with yields above 11%. Higher duration names, ended the month with relatively lower yields because of the inverted curve, leading to lower break-evens, and being less able to stomach further curve movements.

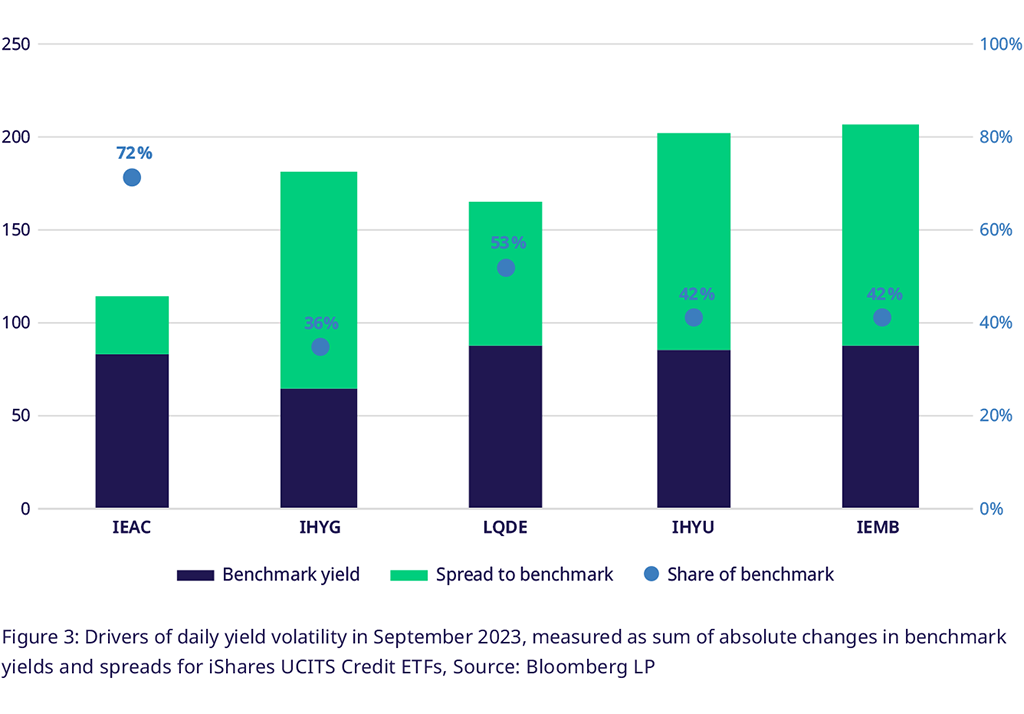

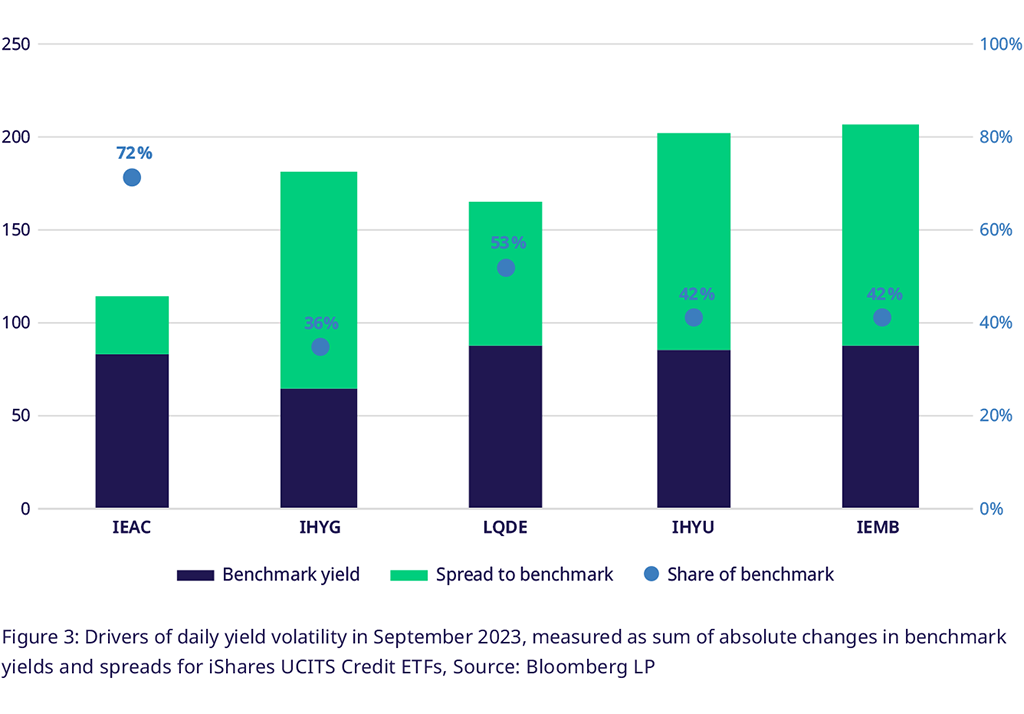

Curve moves remain a dominant driver in investment-grade debt. European high yield spread volatility fairly compensated.

Investors taking on credit risk consider the volatility that this factor contributes to the overall returns of the instrument. In European investment grade, the curve made up 72% of overall yield movements, while the benchmark curve only made up 68% of the total yields, showcasing that (1) taking on high quality credit risk contributed less volatility than expected and (2) hedging both duration and credit risk at the same time is necessary to protect the portfolio. In the lower quality names, investors in IHYG were perfectly compensated for the additional risk they took on, as 63% of daily yield movements stemmed from its spread, while the spread itself made up 63% of the total yield of the instrument.

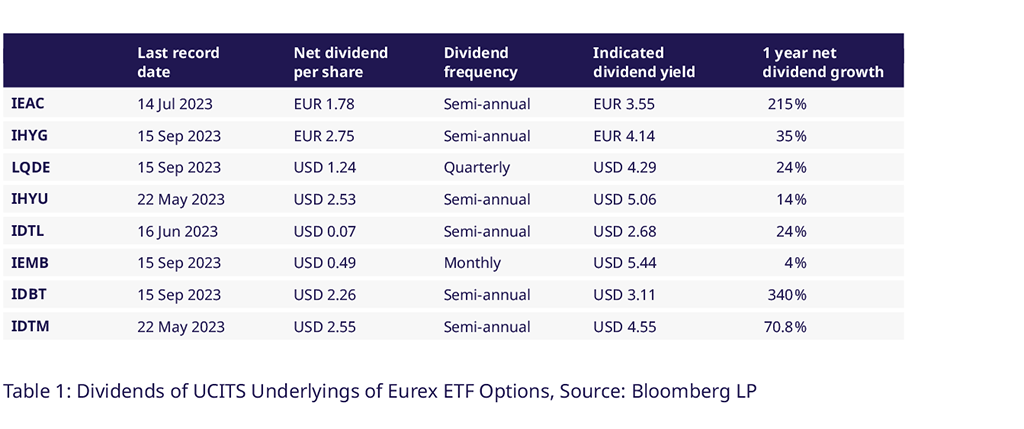

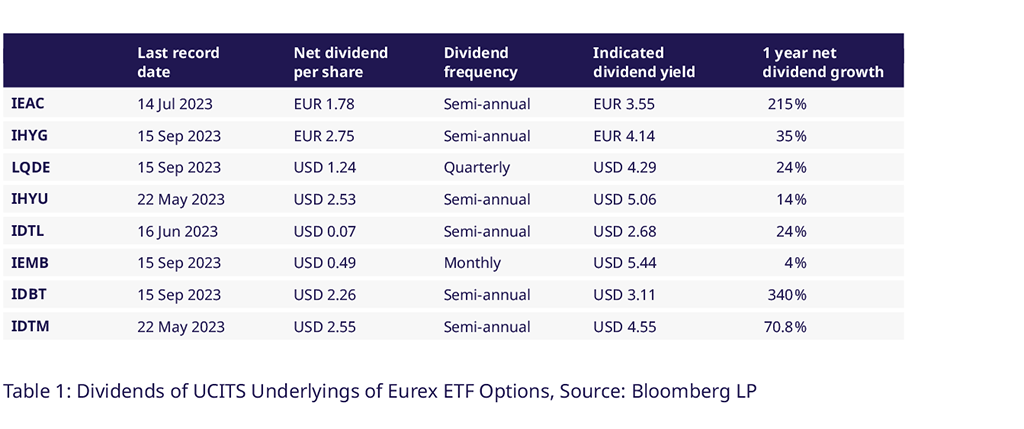

IHYG, LQDE, IEMB, IDBT paid dividends in September, 340% growth in dividend for IDBT. NEEDS EDITING FROM HERE ON

Short term US Treasuries, as held by IDBT, have seen yields increase the strongest over the last one-and-a-half years. This has led to dividends rising 340% over the last 12 months. Going further out, Eurex Options markets price in a $3.29 dividend per share for IHYU in November, which would give an indicated dividend yield of 7.34%.

Utilizing Eurex Credit Futures & Options for Market Positioning

Eurex credit futures and options enable you to hedge existing portfolios against duration and credit risk in one go. Eurex Options on Fixed Income ETFs allow for directional positioning whilst limiting options premium paid with options spreads or more tailored option strategies.

Thinking about trading US Interest rates and volatility using UCITS compliant instruments? Gain exposure to US Treasury markets using the new Options on the IDBT (1-3yr Tenor) and IDTM (7-10yr Tenor) UCITS ETFs.

Contacts