May 25, 2023

Eurex

FIC Credit Market Snapshot May 2023

Ebb and flow of banking woes

Markets relaxed in early April, retreating towards the end of the month

Global markets across European and US Investment Grade Credit relaxed in early April as the uncertainty around the health of the global banking system subsided for a period. The developments around Credit Suisse, Signature Bank and Silicon Valley Bank did not cause a wider fallout, and the new owners of both banks were able to negotiate favorable concessions with respect to sharing prospective losses from the new businesses, limiting potential containment. Still, the biggest question around liquidity remained: How deep will the global contraction of liquidity conditions be?

European UCITS Credit ETFs stay flat, with EUR HY carry cushioning against rising short rates

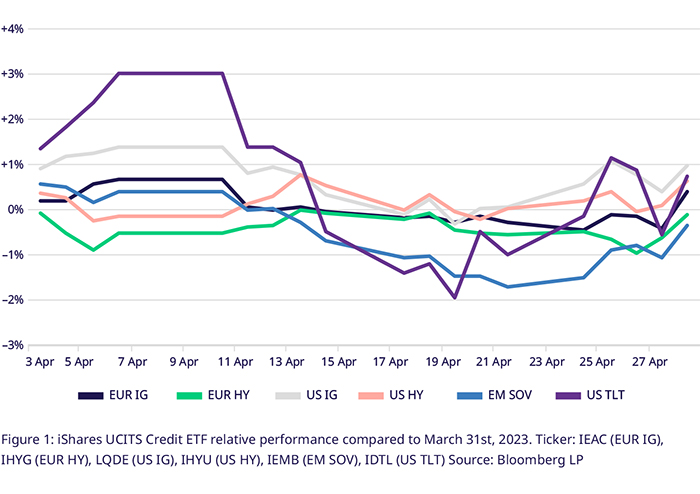

Credit spreads and benchmark yield curves moved in opposite directions during April, with the US and Europe showing inverse behavior. In Europe, the IEAC UCITS ETF capturing EUR IG failed to hold on to early gains in the month, ending April at +0.42%. Even though yields of European High Yield rose around 20bps over the month, a 7.5% carry protected profit and loss metrics. The IHYG UCITS ETF fell by 0.12% over the month.

US IG outperforms HY, EM Sovereign Credit trails driven by long duration

In the US, falling rates supported markets against widening spreads in riskier tranches. USD IG led USD HY and EM Sovereign credit from a total return perspective, with LQDE rising 0.97% over the month, driven by compressing spreads and a falling benchmark yield. Higher risk credit ETFs, such as IHYG (US HY) and IEMB (EM SOV), followed with a price performance of +0.63% and -0.35% (IEMB paid a dividend of 0.4474 on 14 April).

Global IG spreads compress while HY spreads widen, with higher divergence in European markets

While EUR HY ETFs saw higher inflows on a relative basis, spreads of higher-risk bonds in Europe widened 20 bps over April, while EUR IG spreads compressed 8bps. In the US, LQDE saw holdings-based spreads fall 2bps, while IHYU and IEMB saw spreads widen 8bps and 9bps, respectively. Benchmark curves were stable over the whole month, with the 2-year to 10-year tenors of the German curve rising by approx. 2bps, while the US curve fell by 7.2bps -9.1bps in the 3-year to 7-year tenors.

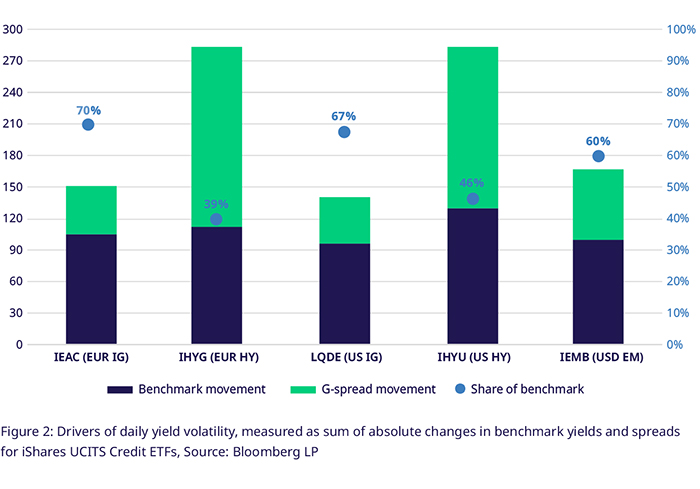

Credit spreads dominate overall PnL, while sovereign curves experience more daily volatility, especially on the long end

In Europe, movements of the benchmark sovereign curve accounted only for about 10% of the yield change between 31 March and 28 April. However, sovereign curves dominated volatility in IEAC, driving 70% of the changes of daily yields. In the US, long end bonds of LQDE and IEMB saw benchmark yields driving more than 60% of daily volatility. High yield bonds held by IHYG and IHYU, which generally have lower duration, were more driven by credit spreads, although the sovereign curve still drove around 40% of yield moves.

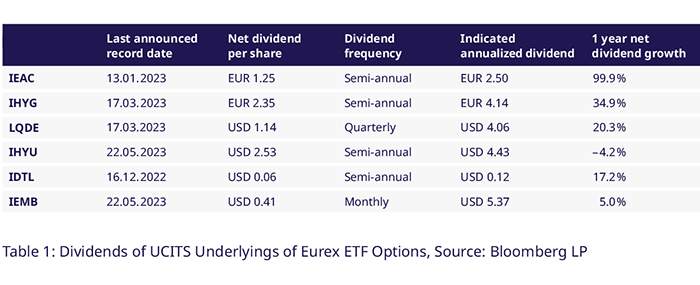

IEMB pays a monthly $0.4474 dividend per share, IHYU set to pay in May

The iShares J.P. Morgan USD EM Bond UCITS ETF (IEMB) paid an annualized gross dividend of $5.3 per share, + 6% month-on-month. Both IEMB and IHYU are set to pay dividends with a record day on 22 May pulling indicated annualized yields to $4.43, $5.37.

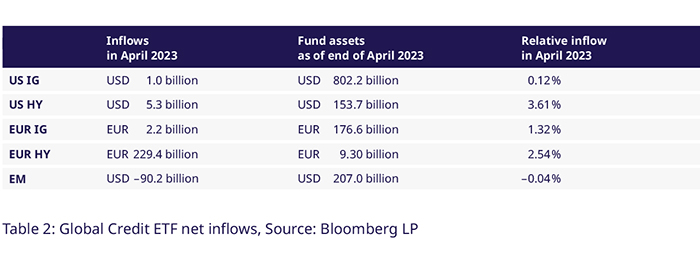

HY ETFs are preferred over IG as US HY ETFs lead Credit ETF markets in total inflows

While USD and EUR Investment Grade (IG) are the largest risk tranches, with $802Bln and €176Bln in AUM, High Yield (HY) ETFs saw higher relative inflows. US HY ETFs saw the highest relative increase versus End-of-March AUM, gaining 3.61% to total around $ 153Bln. EM Fixed Income funds saw outflows of around $90Mln across corporates and sovereigns, with more than $200Bln remaining at the end of the month.

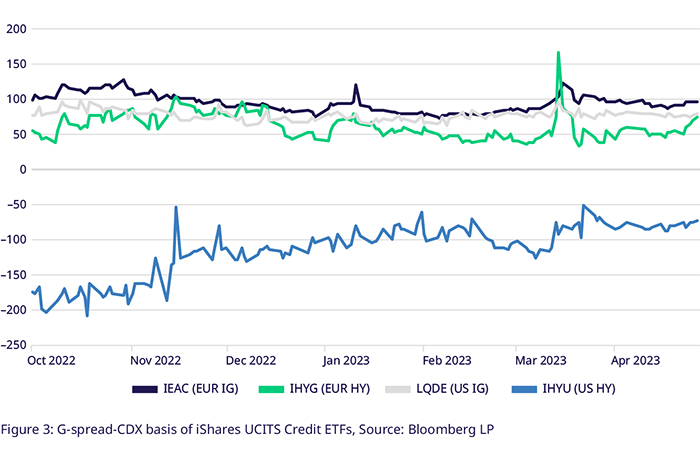

Basis measures between Credit ETFs spreads and OTC CDX spreads trend upwards in HY, slightly contract in IG

After some choppy action around the March banking turmoil, the basis between the IHYG and IHYU G-spreads and the par-spreads of the corresponding credit default swap indices trended slightly upwards in April, rising 20bps and +12bps, respectively. For IHYU, the basis has normalized from the deep negative territory of -200bps late last year. For IEAC and LQDE, the basis was little moved at around 95bps, 75bps.

Utilizing Eurex's Credit Futures & Options for Market Positioning

Eurex Credit Futures and Options enable you to hedge existing portfolios against duration and credit risk in one go. Eurex Options on Fixed Income ETFs allow for directional positioning while limiting options premium paid with options spreads or more tailored option strategies.

With our Bloomberg MSCI Euro Corporate SRI Index Futures (LXYA index) and Bloomberg Liquidity Screened Euro High Yield Bond Index Futures (AHWA Index), market neutral credit spread trades between EUR IG and HY are now also possible at Eurex.

Contacts