- Long duration US Treasurys, Investment Grade suffer from debt-ceiling volatility, USD underlyings of Eurex ETF Options end the month in the red. European UCITS Credit ETFs end flat, with EUR IG regaining in late May

- USD High Yield daily volatility dominated by spreads. However, month-on-month return dominated by short end benchmark rates, more volatile than longer end

- Long end Treasury volatility drives daily volatility and month-on-month return of LQDE, IEMB

- EUR curve retraces upwards shift to end the month almost flat, driving 67% of IG yield volatility

Long duration US Treasuries, Investment Grade suffer from debt-ceiling volatility, USD underlyings of Eurex ETF Options end the month in the red

The fight between Republicans and Democrats over suspending the debt ceiling triggered losses in USD-denominated debt. The US yield curve and USD Investment Grade and High Yield credit spreads widened, driving losses in the third and fourth week of the month. Longer duration Investment Grade and Treasuries were most impacted, while higher yielding, lower duration bonds outperformed on carry, protecting against the moves. The resolution of the debt ceiling drama finally led to relaxation: The iShares UCITS Credit ETFs regained some of the lost ground. From a total return perspective, the USD IG ETF (BBG: LQDE) ended the month down 2.09%, while long term Treasury ETF (IDTL) lost 3.37%. The EM Sovereign Credit ETF (IEMB) and USD HY (IHYU) bounced up but ended the month in the red, with total returns of -1.15%, -1.55%.

European UCITS Credit ETFs end flat, with EUR IG regaining in late May

European high yield bonds experienced headwinds from volatile credit spreads and benchmark yields. However, a 7.5% average YTM in the iShares Euro High Yield UCITS ETF on 28 April provided a cushion of carry that helped protect against said volatility. The fund ended the month up 0.03% after credit spreads jumped 17bps on 31 May. European Investment Grade, which generally has a longer duration, was more impacted by the uncertainty around US solvency, with the iShares EUR Corporates UCITS ETF (IEAC) falling almost 1% before regaining losses on the resolution.

USD High Yield daily volatility dominated by spreads. However, month-on-month returns dominated by short end benchmark rates, more volatile than longer end

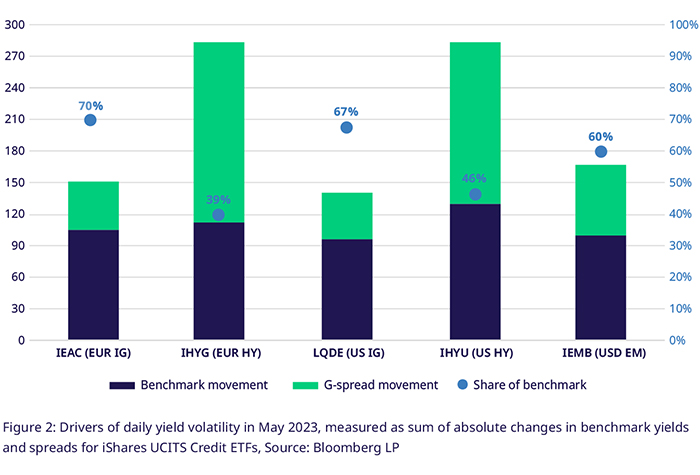

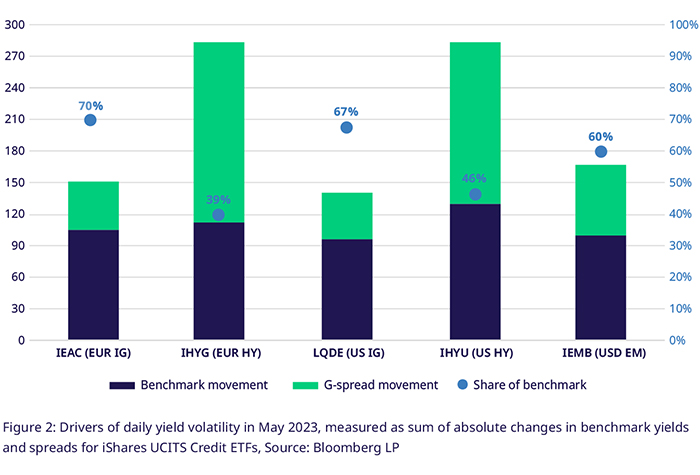

For IHYU, credit spreads accounted for 56% of daily yield movement totaling 294bps. Secondly, we observe the movement over the whole month and gauge the impact of both components over a longer period. When taking the longer horizon, benchmark yields continue to make up more than half the yield movement, as they have since mid-2022. Over the whole month, spreads widened by 22bps, while benchmark yields rose by 27bps.

Long end Treasury volatility drives daily volatility and month-on-month return of LQDE, IEMB

Volatility at the long end of the Treasury curve was slightly lower than at the short end. However, movements in the benchmark curve still made up 63%, 58% of daily yield moves in both names. Returns over the month were also driven by the sovereign curve, as the benchmark yield of LQDE and IEMB rose 22bps, while credit spreads of the two ETFs held up, rising only 7bps, and 5bps over the month, respectively.

The EUR curve retraced its upward shift to almost flat, driving 67% of IG yield volatility

In Europe, yield curves behaved similarly to the US, with more activity on the long end versus the shorter end. This led to benchmark rates making up 67% of the daily yield variation of the EUR IG ETF IEAC. Over the whole month, the benchmark curve stayed almost flat, as benchmark yields fell 3bps for IEAC and rose 2bps for the EUR HY ETF IHYG. The latter saw credit spreads dominating the yield volatility, driving 60% of daily yield movement.

IHYU pays a semi-annual $2.53 dividend per share. IDTL, LQDE and IEMB to pay in June

The iShares USD High Yield UCITS ETF (IHYU) paid an annualized gross dividend of $5.06 per share, + 14.4% since the last payment in late 2022. IEMB paid a $ 0.41 dividend per share, up 6% versus last year. IDTL, LQDE and IEMB are set to pay dividends in June.

IG ETFs broadly preferred by investors, as USD IG ETFs see $2.9Bln of inflows, EUR IG ETFs most preferred on a relative basis

USD IG ETFs continue to hold the most assets, with more than $822Bln under management, which saw inflows of another $2.9Bln over the month. EM funds and US high yield ETFs saw capital being disinvested, with outflows making up 0.15%, 1.04% of the assets as of the end of May. In Europe, EUR IG saw another €2.0Bln allocated, adding another 1.14% to the balance as of the end of May.

Utilizing Eurex's Credit Futures & Options for Market Positioning

Eurex Credit Futures and Options enable you to hedge existing portfolios against duration and credit risk in one go. Eurex Options on Fixed Income ETFs allow for directional positioning while limiting options premium paid with options spreads or more tailored option strategies.

With our Bloomberg MSCI Euro Corporate SRI Index Futures (LXYA index) and Bloomberg Liquidity Screened Euro High Yield Bond Index Futures (AHWA Index), market neutral credit spread trades between EUR IG and HY are now also possible at Eurex.

Contacts