Prices/Quotes

Price Chart

loading...

Statistics

loading...

Specifications

Contract Specifications

Contract standards

Swiss Average Rate Overnight (SARON®), a collateralized reference rate based on actual market transactions and prices in the Swiss inter-bank repo market.

Contract value

CHF 2,500 per index point.

Settlement

Cash settlement, payable on the first Swiss exchange day following the final settlement day.

Price quotation and minimum price change

The price quotation is in index points with three decimal places on an index basis of 100 less the numerical value of the interest rate traded. The minimum price change is 0.005 index points, equivalent to a value of CHf 12.50.

Contract months

Up to 36 months: The twelve nearest quarterly months of the March, June, September and December cycle.

Last trading day and final settlement day

Last trading day is the final settlement day. Final settlement day is the first exchange days prior to the third Wednesday of the respective maturity month, provided that on that day the SIX Swiss Exchange AG has determined the reference interest rate SARON®; otherwise, the exchange day immediately preceding that day. Close of trading in the maturing futures on the last trading day is at 18:00 CET.

Daily settlement price

The daily settlement price for the current maturity month of 3M SARON® Futures is derived from the volume-weighted average of the prices of all transactions during the minute before 17:15 CET (reference point), provided that more than five trades transacted within this period.

For the remaining maturity months, the daily settlement price for a contract is determined based on the average bid/ask spread of the combination order book.

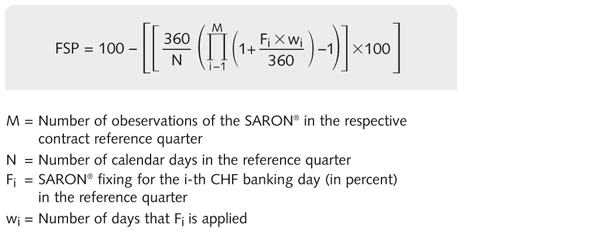

Final settlement price

The final settlement price is established by Eurex on the final settlement day after the last SARON® fixing at 18:00 CET and is determined by the following formula:

To fix the final settlement price, the numerical value of the SARON® rate is rounded to three decimal places and then subtracted from 100..

Block Trades

Admitted to the Eurex Block Trade Service with a Minimum Block Trade Size of 100 contracts.

Market-Making Parameter

All quotation parameters at a glance

- Quotation period

- Maturity range

- Spread class & Maximum Spread

- Minimum Quote Size

Mistrade Parameter

This file provides an overview of mistrade ranges for Options and Futures including information on their behavior close to expiration and in stressed markets.

Crossing Parameters

(section 2.6 Eurex Trading Conditions)

(1) Orders and Quotes relating to the same Instrument or Combined Instrument may, in case they could immediately be executed against each other, neither be entered knowingly by an Exchange Trader or several Exchange Traders of an Admitted Company (a “Cross Trade”) nor pursuant to a prior understanding between Exchange Traders of two different admitted companies (a “Pre-Arranged Trade”), unless the conditions according to Paragraph 2 have been fulfilled. The same shall apply for the entry of Orders as part of a Quote.

(2) A Cross Trade or a Pre-Arranged Trade is admissible if a participant in a Cross Trade or a Pre-Arranged Trade Eurex Trading System, announces his intention to execute a corresponding number of Contracts as Cross Trades or Pre-Arranged Trades in the Order Book (“Trade Request”). The buying participant has to ensure that he himself or the selling participant enters the Trade Request. The Order or Quote giving rise to the Cross Trade or Pre-Arranged Trade must be entered one second at the earliest and 121 seconds at the latest after the entry of the Trade Request. Entering a Trade Request without entering the respective Order or Quote is not admissible.

(3) Paragraphs 1 and 2 shall not apply to Transactions consummated during the netting process in an auction (Number 1.4 Paragraphs 2 and Paragraph 3).

(4) The automated entry functionality for Cross Trades or Pre-Arranged Trades of the Eurex Trading System may be used for entering Cross Trades or Pre-Arranged Trades. In this case, announcement and entry of the corresponding Orders pursuant to Paragraph 2 will be automated.

Trading Hours

Trading Calendar

-

Jan

01

Interest Rates | Equity | Equity Index | Dividends | FX | Volatility | ETF & ETC | Commodity | Cryptocurrency | Holiday

Eurex is closed for trading and clearing (exercise, settlement and cash) in all derivatives

-

Jan

16

Money market index derivatives | Last Trading Day

Last trading day for Options on Three-Month EURIBOR Futures (OEU3, OEM1-4)

-

Jan

16

Money market index derivatives | Last Trading Day

Last trading day for Options on Three-Month Euro STR Futures (OST3, OSM1-2)

-

Jan

19

Money market index derivatives | Last Trading Day

Last trading day for Three-Month EURIBOR Futures

-

Jan

19

Money market index derivatives | Delivery Day

Delivery day for Options on Three-Month Euro STR Futures (OST3, OSM1-2)

-

Jan

19

Money market index derivatives | Delivery Day

Delivery day for Options on Three-Month EURIBOR Futures (OEU3, OEM1-4)

-

Jan

20

Money market index derivatives | Last Trading Day

Last trading day for Three-Month Euro STR Futures

-

Feb

13

Money market index derivatives | Last Trading Day

Last trading day for Options on Three-Month EURIBOR Futures (OEU3, OEM1-4)

-

Feb

13

Money market index derivatives | Last Trading Day

Last trading day for Options on Three-Month Euro STR Futures (OST3, OSM1-2)

-

Feb

16

Money market index derivatives | Delivery Day

Delivery day for Options on Three-Month EURIBOR Futures (OEU3, OEM1-4)

-

Feb

16

Money market index derivatives | Delivery Day

Delivery day for Options on Three-Month Euro STR Futures (OST3, OSM1-2)

-

Feb

16

Money market index derivatives | Last Trading Day

Last trading day for Three-Month EURIBOR Futures

-

Feb

16

Money market index derivatives | Last Trading Day

Last trading day for ECB Dated Euro STR Futures

-

Feb

17

Money market index derivatives | Last Trading Day

Last trading day for Three-Month Euro STR Futures

-

Mar

13

Money market index derivatives | Last Trading Day

Last trading day for Options on Three-Month Euro STR Futures (OST3, OSM1-2)

-

Mar

13

Money market index derivatives | Last Trading Day

Last trading day for Mid Curve Options on Three-Month EURIBOR Futures (OEM1-4)

-

Mar

16

Money market index derivatives | Delivery Day

Delivery day for Mid Curve Options on Three-Month EURIBOR Futures (OEM1-4)

-

Mar

16

Money market index derivatives | Last Trading Day

Last trading day for Options on Three-Month EURIBOR Futures (OEU3)

-

Mar

16

Money market index derivatives | Delivery Day

Delivery day for Options on Three-Month Euro STR Futures (OST3, OSM1-2)

-

Mar

16

Money market index derivatives | Last Trading Day

Last trading day for Three-Month EURIBOR Futures

-

Mar

17

Money market index derivatives | Last Trading Day

Last trading day for 3M SARON® Futures

-

Mar

17

Money market index derivatives | Last Trading Day

Last trading day for Three-Month Euro STR Futures

-

Mar

17

Money market index derivatives | Delivery Day

Delivery day for Options on Three-Month EURIBOR Futures (OEU3)

-

Mar

25

Money market index derivatives | Last Trading Day

Last trading day for ECB Dated Euro STR Futures

-

Apr

03

Interest Rates | Equity | Equity Index | Dividends | Cryptocurrency | Volatility | FX | ETF & ETC | Commodity | Holiday

Eurex is closed for trading and clearing (exercise, settlement and cash) in all derivatives

-

Apr

06

Interest Rates | Equity | Equity Index | Dividends | FX | Volatility | ETF & ETC | Commodity | Cryptocurrency | Holiday

Eurex is closed for trading and clearing (exercise, settlement and cash) in all derivatives

-

Apr

10

Money market index derivatives | Last Trading Day

Last trading day for Options on Three-Month EURIBOR Futures (OEU3, OEM1-4)

-

Apr

10

Money market index derivatives | Last Trading Day

Last trading day for Options on Three-Month Euro STR Futures (OST3, OSM1-2)

-

Apr

13

Money market index derivatives | Delivery Day

Delivery day for Options on Three-Month EURIBOR Futures (OEU3, OEM1-4)

-

Apr

13

Money market index derivatives | Delivery Day

Delivery day for Options on Three-Month Euro STR Futures (OST3, OSM1-2)

-

Apr

13

Money market index derivatives | Last Trading Day

Last trading day for Three-Month EURIBOR Futures

-

Apr

14

Money market index derivatives | Last Trading Day

Last trading day for Three-Month Euro STR Futures

-

May

01

Interest Rates | Equity | Equity Index | Dividends | FX | Volatility | ETF & ETC | Commodity | Cryptocurrency | Holiday

Eurex is closed for trading and clearing (exercise, settlement and cash) in all derivatives

-

May

06

Money market index derivatives | Last Trading Day

Last trading day for ECB Dated Euro STR Futures

-

May

15

Money market index derivatives | Last Trading Day

Last trading day for Options on Three-Month Euro STR Futures (OST3, OSM1-2)

-

May

15

Money market index derivatives | Last Trading Day

Last trading day for Options on Three-Month EURIBOR Futures (OEU3, OEM1-4)

-

May

18

Money market index derivatives | Delivery Day

Delivery day for Options on Three-Month Euro STR Futures (OST3, OSM1-2)

-

May

18

Money market index derivatives | Delivery Day

Delivery day for Options on Three-Month EURIBOR Futures (OEU3, OEM1-4)

-

May

18

Money market index derivatives | Last Trading Day

Last trading day for Three-Month EURIBOR Futures

-

May

19

Money market index derivatives | Last Trading Day

Last trading day for Three-Month Euro STR Futures

-

Jun

12

Money market index derivatives | Last Trading Day

Last trading day for Mid Curve Options on Three-Month EURIBOR Futures (OEM1-4)

-

Jun

12

Money market index derivatives | Last Trading Day

Last trading day for Options on Three-Month Euro STR Futures (OST3, OSM1-2)

-

Jun

15

Money market index derivatives | Delivery Day

Delivery day for Mid Curve Options on Three-Month EURIBOR Futures (OEM1-4)

-

Jun

15

Money market index derivatives | Last Trading Day

Last trading day for Options on Three-Month EURIBOR Futures (OEU3)

-

Jun

15

Money market index derivatives | Delivery Day

Delivery day for Options on Three-Month Euro STR Futures (OST3, OSM1-2)

-

Jun

15

Money market index derivatives | Last Trading Day

Last trading day for Three-Month EURIBOR Futures

-

Jun

16

Money market index derivatives | Last Trading Day

Last trading day for 3M SARON® Futures

-

Jun

16

Money market index derivatives | Last Trading Day

Last trading day for Three-Month Euro STR Futures

-

Jun

16

Money market index derivatives | Delivery Day

Delivery day for Options on Three-Month EURIBOR Futures (OEU3)

-

Jun

17

Money market index derivatives | Last Trading Day

Last trading day for ECB Dated Euro STR Futures

-

Jul

10

Money market index derivatives | Last Trading Day

Last trading day for Options on Three-Month Euro STR Futures (OST3, OSM1-2)

-

Jul

10

Money market index derivatives | Last Trading Day

Last trading day for Options on Three-Month EURIBOR Futures (OEU3, OEM1-4)

-

Jul

13

Money market index derivatives | Delivery Day

Delivery day for Options on Three-Month Euro STR Futures (OST3, OSM1-2)

-

Jul

13

Money market index derivatives | Delivery Day

Delivery day for Options on Three-Month EURIBOR Futures (OEU3, OEM1-4)

-

Jul

13

Money market index derivatives | Last Trading Day

Last trading day for Three-Month EURIBOR Futures

-

Jul

14

Money market index derivatives | Last Trading Day

Last trading day for Three-Month Euro STR Futures

-

Jul

29

Money market index derivatives | Last Trading Day

Last trading day for ECB Dated Euro STR Futures

-

Aug

14

Money market index derivatives | Last Trading Day

Last trading day for Options on Three-Month EURIBOR Futures (OEU3, OEM1-4)

-

Aug

14

Money market index derivatives | Last Trading Day

Last trading day for Options on Three-Month Euro STR Futures (OST3, OSM1-2)

-

Aug

17

Money market index derivatives | Delivery Day

Delivery day for Options on Three-Month EURIBOR Futures (OEU3, OEM1-4)

-

Aug

17

Money market index derivatives | Delivery Day

Delivery day for Options on Three-Month Euro STR Futures (OST3, OSM1-2)

-

Aug

17

Money market index derivatives | Last Trading Day

Last trading day for Three-Month EURIBOR Futures

-

Aug

18

Money market index derivatives | Last Trading Day

Last trading day for Three-Month Euro STR Futures

-

Sep

11

Money market index derivatives | Last Trading Day

Last trading day for Options on Three-Month Euro STR Futures (OST3, OSM1-2)

-

Sep

11

Money market index derivatives | Last Trading Day

Last trading day for Mid Curve Options on Three-Month EURIBOR Futures (OEM1-4)

-

Sep

14

Money market index derivatives | Delivery Day

Delivery day for Mid Curve Options on Three-Month EURIBOR Futures (OEM1-4)

-

Sep

14

Money market index derivatives | Delivery Day

Delivery day for Options on Three-Month Euro STR Futures (OST3, OSM1-2)

-

Sep

14

Money market index derivatives | Last Trading Day

Last trading day for Options on Three-Month EURIBOR Futures (OEU3)

-

Sep

14

Money market index derivatives | Last Trading Day

Last trading day for Three-Month EURIBOR Futures

-

Sep

15

Money market index derivatives | Last Trading Day

Last trading day for 3M SARON® Futures

-

Sep

15

Money market index derivatives | Last Trading Day

Last trading day for Three-Month Euro STR Futures

-

Sep

15

Money market index derivatives | Delivery Day

Delivery day for Options on Three-Month EURIBOR Futures (OEU3)

-

Sep

16

Money market index derivatives | Last Trading Day

Last trading day for ECB Dated Euro STR Futures

-

Oct

16

Money market index derivatives | Last Trading Day

Last trading day for Options on Three-Month EURIBOR Futures (OEU3, OEM1-4)

-

Oct

16

Money market index derivatives | Last Trading Day

Last trading day for Options on Three-Month Euro STR Futures (OST3, OSM1-2)

-

Oct

19

Money market index derivatives | Delivery Day

Delivery day for Options on Three-Month Euro STR Futures (OST3, OSM1-2)

-

Oct

19

Money market index derivatives | Delivery Day

Delivery day for Options on Three-Month EURIBOR Futures (OEU3, OEM1-4)

-

Oct

19

Money market index derivatives | Last Trading Day

Last trading day for Three-Month EURIBOR Futures

-

Oct

20

Money market index derivatives | Last Trading Day

Last trading day for Three-Month Euro STR Futures

-

Nov

04

Money market index derivatives | Last Trading Day

Last trading day for ECB Dated Euro STR Futures

-

Nov

13

Money market index derivatives | Last Trading Day

Last trading day for Options on Three-Month EURIBOR Futures (OEU3, OEM1-4)

-

Nov

13

Money market index derivatives | Last Trading Day

Last trading day for Options on Three-Month Euro STR Futures (OST3, OSM1-2)

-

Nov

16

Money market index derivatives | Delivery Day

Delivery day for Options on Three-Month EURIBOR Futures (OEU3, OEM1-4)

-

Nov

16

Money market index derivatives | Delivery Day

Delivery day for Options on Three-Month Euro STR Futures (OST3, OSM1-2)

-

Nov

16

Money market index derivatives | Last Trading Day

Last trading day for Three-Month EURIBOR Futures

-

Nov

17

Money market index derivatives | Last Trading Day

Last trading day for Three-Month Euro STR Futures

-

Dec

11

Money market index derivatives | Last Trading Day

Last trading day for Mid Curve Options on Three-Month EURIBOR Futures (OEM1-4)

-

Dec

11

Money market index derivatives | Last Trading Day

Last trading day for Options on Three-Month Euro STR Futures (OST3, OSM1-2)

-

Dec

14

Money market index derivatives | Delivery Day

Delivery day for Mid Curve Options on Three-Month EURIBOR Futures (OEM1-4)

-

Dec

14

Money market index derivatives | Delivery Day

Delivery day for Options on Three-Month Euro STR Futures (OST3, OSM1-2)

-

Dec

14

Money market index derivatives | Last Trading Day

Last trading day for Options on Three-Month EURIBOR Futures (OEU3)

-

Dec

14

Money market index derivatives | Last Trading Day

Last trading day for Three-Month EURIBOR Futures

-

Dec

15

Money market index derivatives | Last Trading Day

Last trading day for Three-Month Euro STR Futures

-

Dec

15

Money market index derivatives | Last Trading Day

Last trading day for 3M SARON® Futures

-

Dec

15

Money market index derivatives | Delivery Day

Delivery day for Options on Three-Month EURIBOR Futures (OEU3)

-

Dec

23

Money market index derivatives | Last Trading Day

Last trading day for ECB Dated Euro STR Futures

-

Dec

24

Interest Rates | Equity | Equity Index | Dividends | Volatility | ETF & ETC | Cryptocurrency | Commodity | FX | Holiday

Eurex is closed for trading in all derivatives

-

Dec

25

Interest Rates | Equity | Equity Index | Dividends | FX | Volatility | ETF & ETC | Commodity | Cryptocurrency | Holiday

Eurex is closed for trading and clearing (exercise, settlement and cash) in all derivatives

-

Dec

31

Interest Rates | Equity | Equity Index | Dividends | Volatility | ETF & ETC | Cryptocurrency | Commodity | FX | Holiday

Eurex is closed for trading in all derivatives

Transaction Fees

| Fee Type | Fee |

|---|---|

| Exchange transactions: Standard fees (A-, M- and P-accounts) | CHF 0.50 per contract |

| TES transactions / Eurex EnLight: Standard fees (A-, M- and P-accounts) | CHF 0.75 per contract |

| Position Closing Adjustments (A-accounts) | CHF 1.00 per contract |

| Position Closing Adjustments (M- and P-accounts) | CHF 0.80 per contract |

| Cash settlement (A-accounts) | CHF 0.50 per contract |

| Cash settlement (M- and P-accounts) | CHF 0.40 per contract |

| Position transfer with cash transfer | CHF 13.00 per transaction |

Order Book

Content wird geladen.