Product Overview

Daily Options

Three-Month Euro STR Futures

Credit Index Futures

EURO STOXX 50® Index Futures

Fixed Income Futures

Fixed Income Options

STIR Futures & Options

Credit Index Futures

Financing of Futures CTDs

Product Overview

Daily Options

Three-Month Euro STR Futures

Credit Index Futures

EURO STOXX 50® Index Futures

Product Overview

Daily Options

Three-Month Euro STR Futures

Credit Index Futures

EURO STOXX 50® Index Futures

STOXX

MSCI

FTSE

DAX

Mini-DAX

Micro Product Suite

Daily Options

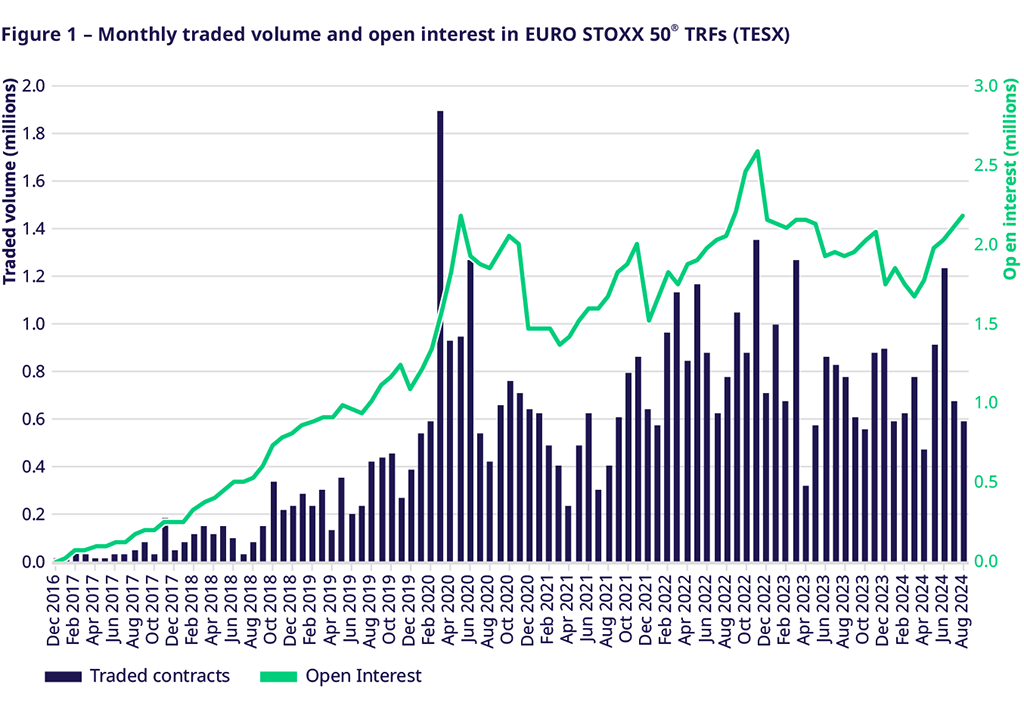

Index Total Return Futures

ESG Index Derivatives

Country Indexes

Product Overview

Daily Options

Three-Month Euro STR Futures

Credit Index Futures

EURO STOXX 50® Index Futures

Product Overview

Daily Options

Three-Month Euro STR Futures

Credit Index Futures

EURO STOXX 50® Index Futures

Product Overview

Daily Options

Three-Month Euro STR Futures

Credit Index Futures

EURO STOXX 50® Index Futures

Product Overview

Daily Options

Three-Month Euro STR Futures

Credit Index Futures

EURO STOXX 50® Index Futures

Product Overview

Daily Options

Three-Month Euro STR Futures

Credit Index Futures

EURO STOXX 50® Index Futures

Product Overview

Daily Options

Three-Month Euro STR Futures

Credit Index Futures

EURO STOXX 50® Index Futures

Product Overview

Daily Options

Three-Month Euro STR Futures

Credit Index Futures

EURO STOXX 50® Index Futures

Product Overview

Daily Options

Three-Month Euro STR Futures

Credit Index Futures

EURO STOXX 50® Index Futures

Exchange Participants

Market Maker Futures

Market Maker Options

ISV & service provider

3rd Party Information Provider

Market data vendors

Brokers

Multilateral and Brokerage Functionality

Block Trades

Delta TAM

T7 Entry Service via e-mail

Vola Trades

Additional contract versions

Exchange for Physicals

Trade at Index Close

Exchange for Swaps

Non-disclosure facility

Market statistics (online)

Trading statistics

Monthly statistics

Eurex Repo statistics

Snapshot summary report

Product parameter files

T7 Entry Service parameters

EFS Trades

EFP-Fin Trades

EFP-Index Trades

MiFID2 Commodity Derivatives Instruments

Total Return Futures conversion parameters

Product and Price Report

Variance Futures conversion parameters

Suspension Reports

Position Limits

RDF Files

Prices Rolling Spot Future

Notified Bonds | Deliverable Bonds and Conversion Factors

Risk parameters and initial margins

Securities margin groups and classes

Haircut and adjusted exchange rate

Cross-Project-Calendar

Readiness for projects

Readiness for products

T7 Release 14.0

T7 Release 13.1

T7 Release 13.0

T7 Release 12.1

Member Section Releases

Simulation calendar

Archive

Direct market access from the U.S.

Eligible options under SEC class No-Action Relief

Eligible foreign security futures products under 2009 SEC Order and Commodity Exchange Act

U.S. Introducing Broker direct Eurex access

Newsletter Subscription

Circulars & Newsflashes Subscription

Corporate Action Information Subscription

Circulars & Newsflashes