Aug 10, 2023

Eurex

MiFID II/MiFIR order flagging requirements: Short code solution enhancement

1. Introduction

As announced with Eurex circular 043/23, Eurex will introduce a dedicated validation scheme for the submission of short codes and algo IDs in the T7 fields Execution ID, Investment Decision ID, and their related qualifiers, as well as the Client ID in all trading interfaces with T7 Release 12.0 on 20 November 2023.

T7 simulation start: 11 September 2023

T7 production start: 20 November 2023

2. Required action

Trading Participants must submit orders and quotes according to the ESMA regulatory requirements, which depend on the trading capacity. Please find detailed information in the document “MiFID II/MiFIR Flagging Requirements - Execution Decision, Investment Decision, Client ID and DMA” on the Eurex website www.eurex.com under the following path:

Rules & Regs > MiFID II/MiFIR > Client & Member Reference Data

Short codes of the natural persons who are primarily responsible for the Execution Decision and Investment Decision (if applicable) must be available for submission in the MiFID fields and registered with the trading venues. Especially trader short code registrations shall be checked, as implicit mappings of a Trader ID to its National ID will no longer be supported. The Execution ID and its qualifier will become explicitly mandatory in the T7 Trader GUI and in the TES Auto Approval Rules. TES Approval Rules need to be checked and adapted where necessary.

In addition to flagging requirements, Trading Participants must ensure that short codes and algo IDs have a value equal to or greater than 1. Submission of a zero as short code or algo ID will technically be disabled as the value zero is not a permissible value.

3. Details of the initiative

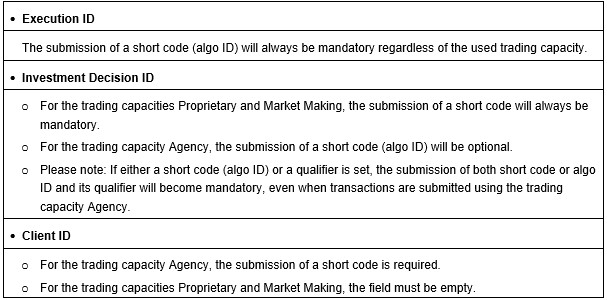

With the new validation scheme for the submission of short codes and algo IDs, the following fields become mandatory:

Submission of a zero as short code (algo ID) will technically be disabled because the value zero is not a permissible value.

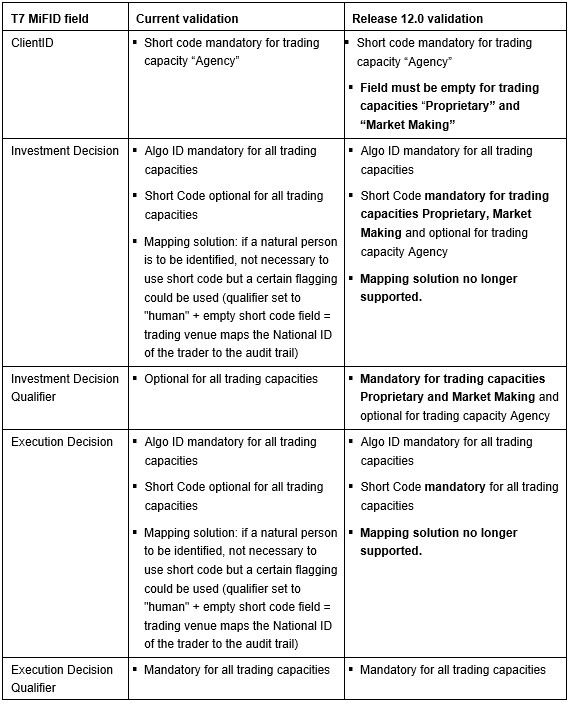

Overview of T7 MiFID field validation enhancements

For the identification of a natural person, the usage of a short code will be mandatory in the Execution Decision ID and in the Investment Decision ID. The mapping solution, which was supported before T7 Release 12.0, will not be offered any longer. The mapping solution enabled Trading Participants to submit an empty Execution Decision ID or Investment Decision ID and to set the respective qualifier to “human”, which led to the mapping of the submitting trader’s national ID into the trading venue’s audit trail by Deutsche Börse. However, the regulatory requirements are unchanged.

For further details about the T7 MiFID field validations, please follow the T7 Release 12.0 publications on the Eurex website www.eurex.com under the following path:

Support > Initiatives & Releases > T7 Release 12.0

Further information

Recipients: | All Trading Participants of Eurex Deutschland and Vendors | |

Target groups: | Front Office/Trading, Middle + Backoffice, IT/System Administration, Auditing/Security Coordination | |

Related circular: | Eurex Circular 043/23 | |

Contact: | Your Key Account Manager or client.services@eurex.com; for technical questions: your Technical Key Account Manager or cts@deutsche-boerse.com | |

Web: | Rules & Regs > MiFID II/MiFIR > Client & Member Reference Data; Support > Initiatives & Releases > T7 Release 12.0 | |

Authorized by: | Michael Peters |