Eurex's ESG Derivatives launched 3.5 years ago and are the most liquid ESG futures in volumes and/or traded contracts. However, some portfolio managers remain concerned about whether liquidity is strong enough to meet their needs. For those on the fence, check out the key stats, main drivers and key indicators proving liquidity below. Taking a closer look at the liquidity profile behind a specific contract is important in order to draw more profound conclusions.

ESG derivatives development – Open Interest and Average Daily Volumes

Total traded volume of Eurex's ESG Derivatives across Equity Index and Fixed Income exceeded 46.5 EUR billion in 2022, reaching an Average Daily Volume (ADV) of EUR 240 million. In YTM September 2022, total open interest stood at 4.4 billion EUR and 0.8 billion EUR, respectively. Traded contracts in 2022 reached over 2.2 million contracts.

Answering the ESG order book liquidity question

The number of active customers trading in the order book reached new high

Increased activity in the order book – balanced split between order book and blocks

Overall activity in 28 ESG equity index derivatives has increased, with 43% of all traded volume YTM Sep 2022 traded via our order book. This split between screen and block activity is another strong indicator that liquidity is available.

ESG derivatives on STOXX® & MSCI ESG indexes represent the strongest example, with respective 54% and 294% increases in traded contracts via our order book YoY.

In addition, block liquidity provision in some of our key contracts, such as the STOXX® Europe 600 ESG Exclusions Future, is very competitive, with many of the liquidity providers competing to win ESG-related orders.

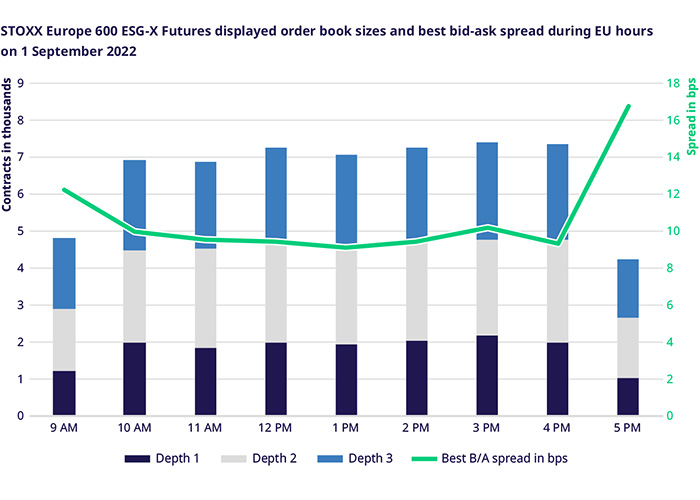

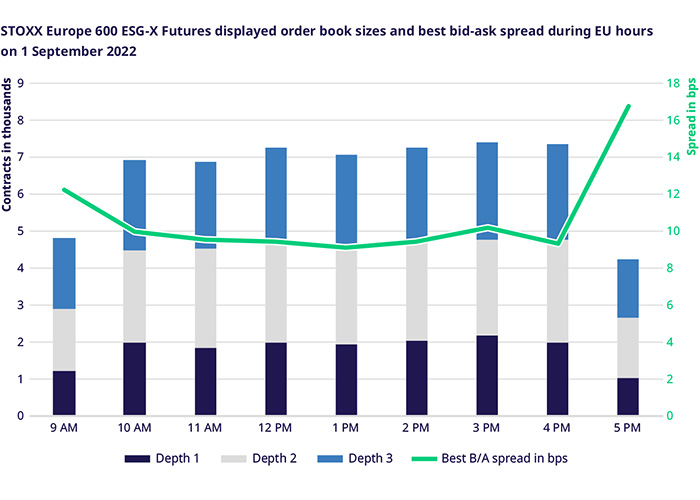

Consistent spreads - with increased order book liquidity across ESG derivatives contracts.

Consistent spreads across order book size are indicators for performant and liquid contracts. This is particularly true for STOXX® Europe 600 ESG-X Futures, EURO STOXX 50® ESG Index Futures, MSCI USA ESG Screened Futures and MSCI EM ESG Screened Futures

The above graph shows up to three levels of order book depth (available size orders across both bid and ask sides) and the best bid-ask spread displayed in bps for STOXX® Europe 600 ESG-X Futures. During EU trading hours, traders can tap, on average, around 2,000 contracts on the top bid-ask levels, which is equivalent to roughly €30m of notional, whereas the first three tiers of displayed depth consist of 7,000 contracts or €103 m of notional value. The typical best bid-ask spread is at the level of 10 bps.

Contacts