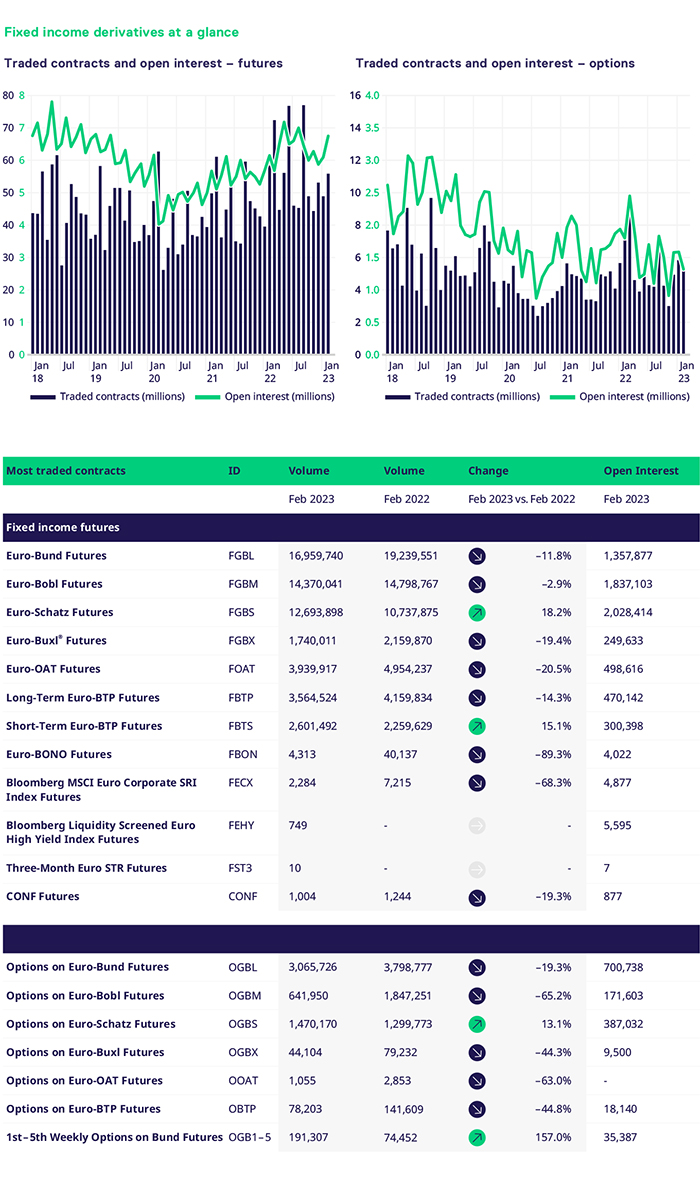

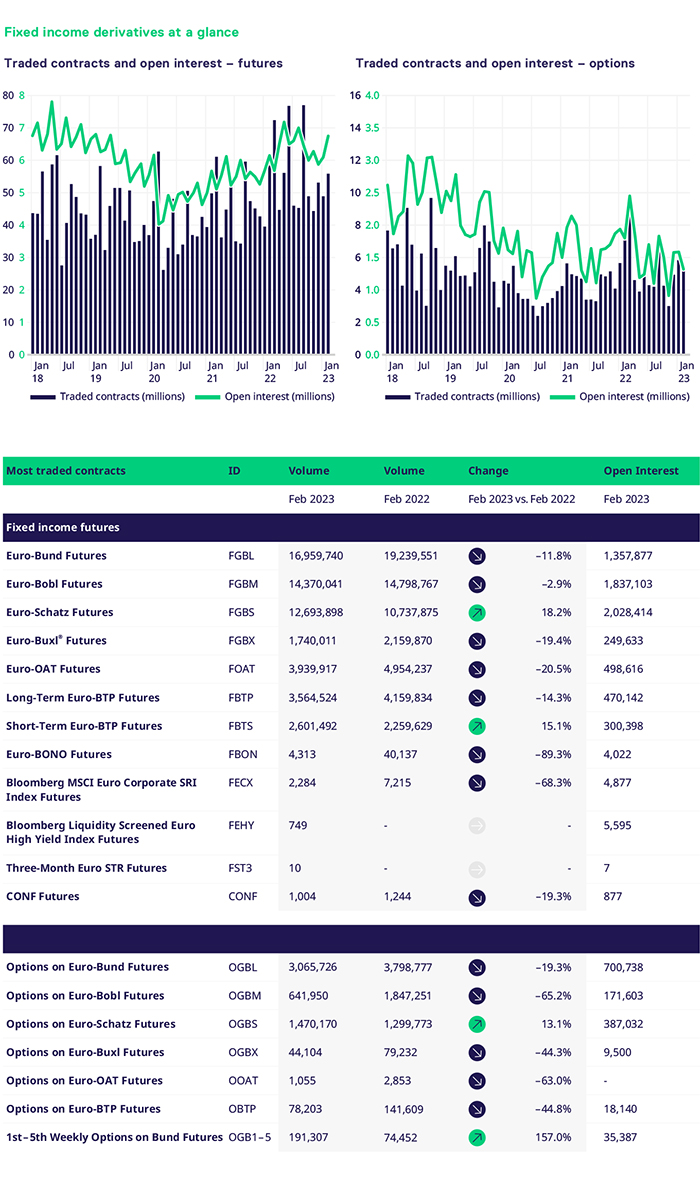

A tale of two halves is how I would summarize quarter one (Q1) to date. January saw a strong start across the portfolio, benefitting from the tailwinds of 2022. February, on the other hand, had a hard act to follow, not just from January’s figures. February 2022 had a significant catalyst as the conflict between Russia and Ukraine unfolded. Roll forward twelve months and February 2023 was sanguine. Transparency and honesty are two things that I value and are important. In the context of our business’s performance, even more so. February was challenging in terms of volumes, and we can see that in the numbers. In futures, we had two outliers, Schatz and short-term Italian (BTS) contracts. Both saw double-digit growth, 18.2% and 15.1%, respectively, trading c.12.7m and 2.6m contracts. This is something that I feel will be shared with our peer groups' performance, e.g., front-end focused. In the options space, Schatz was again the outlier, seeing a 13.1% growth compared to the same period last year. Weekly Bund options continued to outperform, with volumes 157% higher versus February 2022, trading 191k contracts. Another segment that continued to benefit from the positive momentum was FX, albeit concentrated on one underlying, USD/KRW. This helped drive the overall volumes 70% higher.

The numbers, for me, don’t tell the whole story. As a team, we expected periods in 2023 where the business would face headwinds and challenges. We should not shy away from acknowledging this. We should, however, trust the process we have in place, which is to deliver on the key initiatives the team is working on. Moreover, the team has been tirelessly working with all our stakeholders to ensure we are well-positioned to accelerate nascent markets, focusing on the details. Victories are won in the details. We are committed to getting the details right, which will pay dividends in the medium to long term. What does this specifically mean? Creating critical mass (takers vs. makers, end clients), diversity of participants and accessing alternative liquidity pools. By no means is this exhaustive, and there are more components.

As we move into March and the roll, volumes have been trending higher across the board. The team is concentrating and working alongside our members to build out the newly launched initiatives, especially €STR. We faced some external challenges and are slowly starting to turn the corner in that respect. This reinforces my trust and confidence in our process and approach, which will begin to bear fruit in the months ahead. Member readiness is increasing, which should translate into volume growth. In credit, volumes have started to pick up as we enter March, with an emphasis on our ETF options segment. Several significant initiatives are in the pipeline for the year, which I will share further as we get closer to execution.

For the remainder of Q1, there are several tailwinds that we think will support our business. In rates, there appears to be further upside in the absolute level of rates and/or divergence of opinion in where terminal rates will or should land. Rates volatility has come in from the highs but has more catalysts in the months ahead. Dividend yields vs. fixed income yield is at an interesting juncture, as is the absolute level, or lack thereof, of equity volatility. My colleague and counterpart in Equities has been raising this point, together with a divergence on forward looking P/E ratios, which, if it breaks down, could be a catalyst for downside in stocks and, hence spill over into Fixed Income. What will be interesting in Fixed Income is how many positions get rolled into the June expiry. A focus for me and the team is how Open Interest (OI) develops. Generally, OI in both futures and options has been trending higher and could continue. As Europe becomes more attractive from a Fixed Income perspective, new capital will flow in, which should support our business.

Lastly, but most importantly, thank you to our members, clients and colleagues for their support and patience on initiatives. We are grateful and humbled by your continued support. I’d like to personally thank our members, the team and colleagues for your commitment to executing our initiatives and ‘putting up’ with my intensity; it is appreciated. We will discuss the rolls in more detail in the next update.