As we enter the summer period this year, I can’t help but think this summer may be more interesting than previous years. Volatility continued throughout Q2, and we saw raised volumes across the portfolio which I expect to continue into July and August. Futures and Options volumes were 31.0% and 9.2% higher respectively. Listed FX volumes enjoyed a strong quarter, seeing an increase of 227% versus Q1. Without sounding like a broken record, these numbers would not be possible without the support of our liquidity providers, members, clients, and colleagues. Q2 proved a very challenging quarter from a volatility perspective, with the Bund exhibiting 300-point intraday moves. Yes, we were quick to apply ‘fast markets’ in June, which was prudent and allowed for continuous trading, ensuring clients could put risk on and off. Despite the raised volatility, we were able to engage frequently with our members to ensure that key initiatives remained on track and to exchange perspectives, insights, and updates on the current situation and for the remainder of the year.

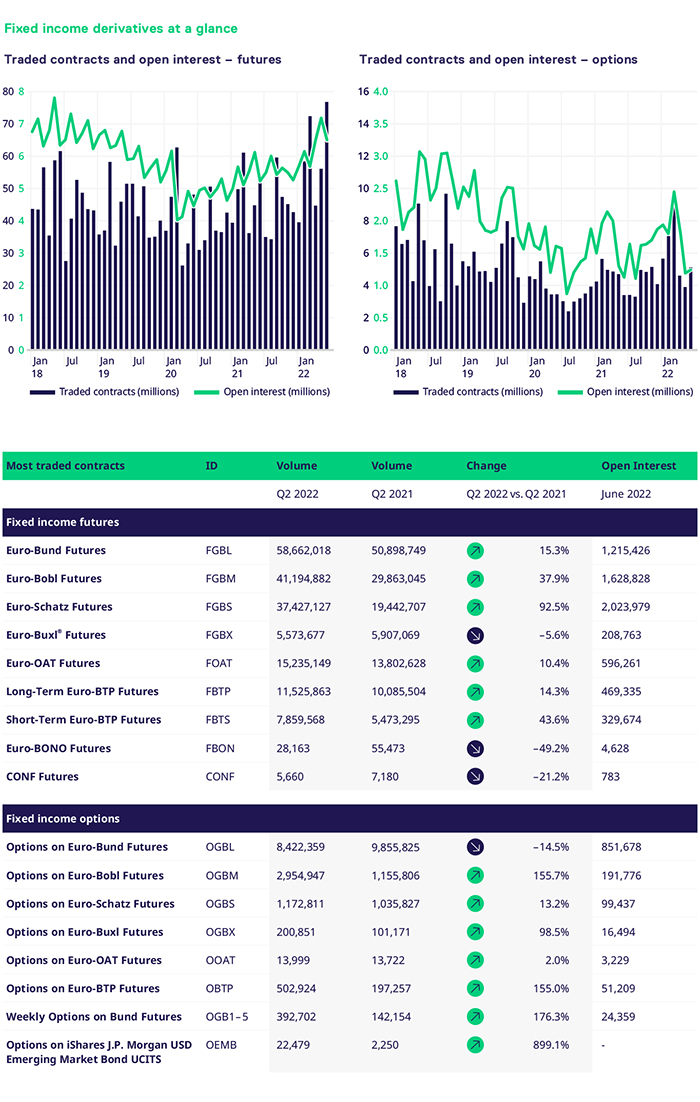

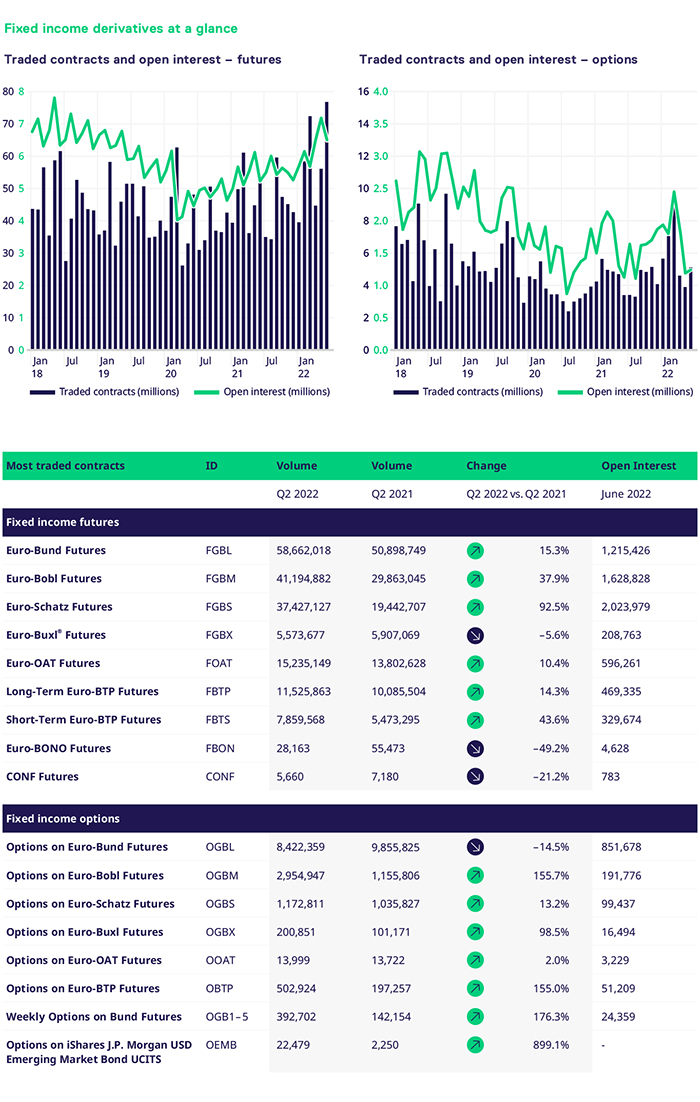

Q2 was a strong period for the FIC portfolio. The core German segment performed strongly across the board, underpinned by the macroeconomic backdrop. Bund, Bobl and Schatz all saw double digit increases in volumes, 15.3%, 37.9% and 92.5% respectively. The long end of the curve was 5.6% lower versus the same period last year with c.5.57m contracts trading. The Italian and French segments continue their positive momentum with volumes 14.3%, 43.6% and 10.4% higher. The front end of the Italian curve continues to be a strong outperformer throughout the course of 2022.

In June, the macroeconomic backdrop was still supportive of our portfolio. Central banks across the globe are grappling with increasingly elevated levels of inflation at a time when voices are growing ever louder on recessionary concerns. Considering the increased rhetoric around the factors mentioned, options volumes were well supported across the portfolio in Q2. The German segment outperformed with exception of the 10y, where Bund options saw a decline versus Q2’21, with c.8.4m contracts trading versus c.9.85m in Q1 last year. On the other hand, weekly options on Bunds saw a significant increase in volumes of 176%, with ADV above 10k some days. The belly of the curve and the front end saw a significant percentage increase with Bobl volumes 155.7% and Schatz 13.2% higher versus 2021. Bobl and Schatz segments traded 2.95m and 1.172m contracts respectively. The long end of the curve outperformed with an increase of 98.5%, trading c200k contracts.

The French OAT segment bounced back in June, which saw volumes 2% higher versus the same period last year. The Italian BTP segment saw a material increase of 155%, trading c.500k contracts. The Italian segment has performed strongly throughout the course of 2022, with ADV levels significantly above 2021 levels.

Moving away from core rates, the credit portfolio continues to build on the strong momentum of 2022. The Corporate Bond SRI Index futures traded over 17.5k contracts and is now the second largest ESG contract measured by notional outstanding across all asset classes and globally. This is a huge achievement for our team and our members. New clients were activated throughout the quarter which should help the team accelerate the growth in H2 2022. ETF options continued to see pockets of liquidity, with volumes in Emerging Markets 899% higher versus the same period last year, trading 22.4k contracts. As spreads continue to be volatile, we are confident that the ETF segment should see this momentum maintained.

In FX, we had a very solid quarter. The team had several significant clients become active which helped increase our overall numbers. The portfolio saw volumes 227% higher versus the same period last year. Open interest in the entire segment grew at the same time by 169% to c80k contracts, led by an increase of OI in the EUR/USD contract of 220%. Having worked with the team and clients closely, we are confident that this segment will accelerate in the second half of 2022.

As we move into the summer, the expectation is we continue to see significant intraday volatility. There is sufficient event risk and, with the holiday period in full swing, there is merit in seeing larger than implied market moves. The team will be working tirelessly with our members to ensure the smooth and continuous operating of our markets. With this, I wish you all a very relaxing and rejuvenating holidays with your families.