In this update, I’ll provide an overview of the key topics and focus areas for the FIC derivatives business. As outlined at the beginning of the year, we have three key focus areas: STIR, Credit and FX. These are markets we believe will help develop and further strengthen our portfolio.

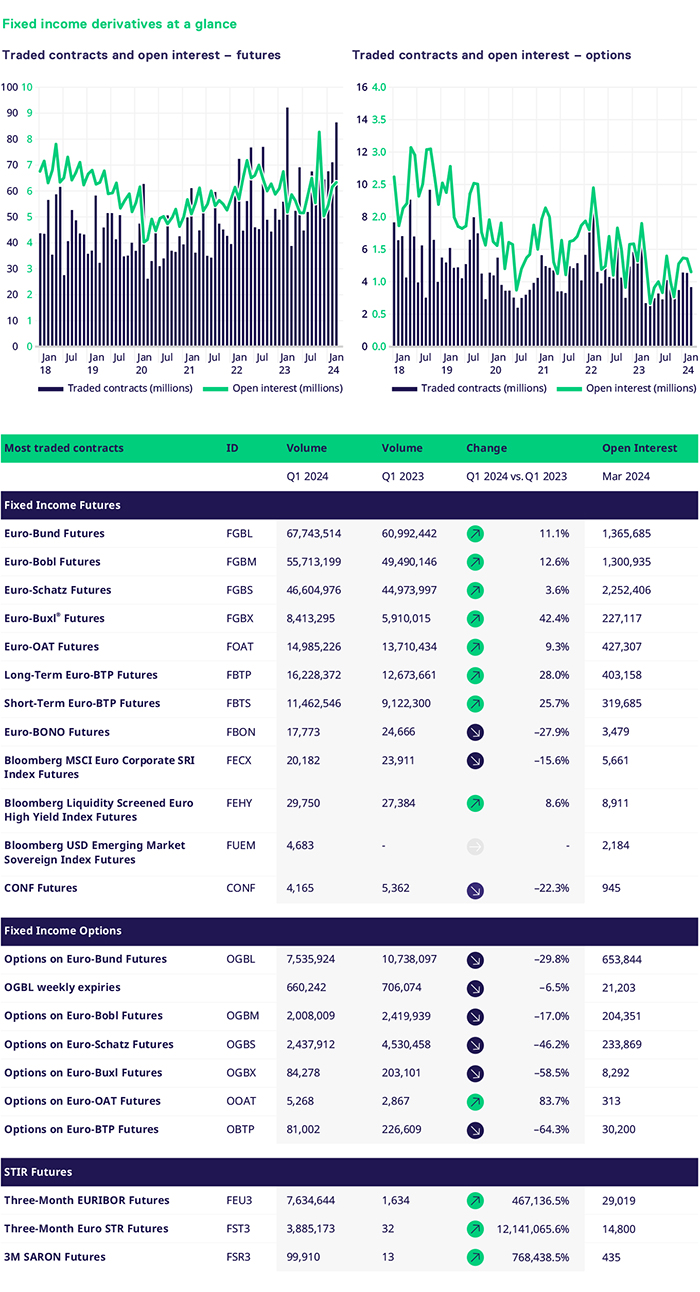

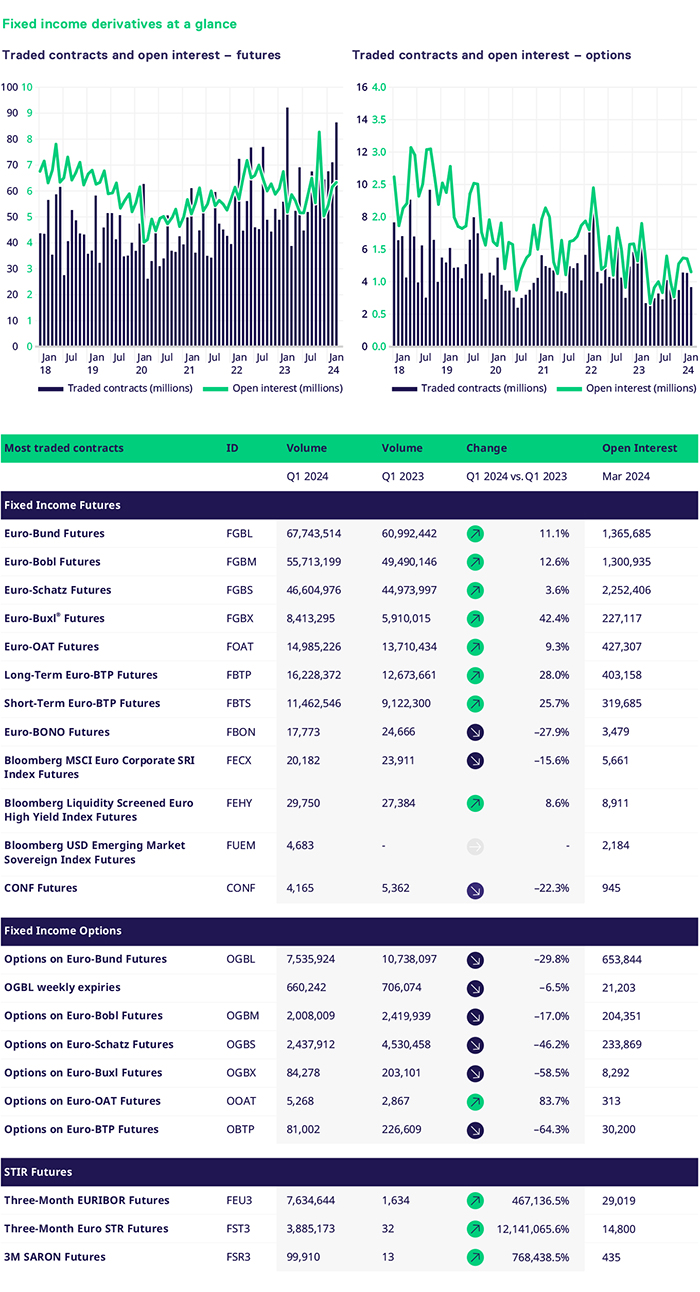

Overall, Q1 2024 was a record quarter; the business went from strength to strength, posting double-digit growth (c.14%). Admittedly, this was driven by a strong outperformance of our futures franchise. With volatility languishing around 8%, options volume was anaemic. That being said, it does feel like markets are underpricing risk and the team expects to see a pick-up in volatility into the summer.

STIR - This is a nascent segment for Eurex, yet the volume development has been solid. We are performing ahead of our expectations here. I have always maintained this is a long-term project and the team feels we are well placed to succeed in this sector. Volumes are increasing MoM, and with the changes we made, open interest is growing. We expect to see both increase significantly in Q2. The number and diversity of end users continue to increase, which is another reason to believe we are on the right path. We are humbled by the market’s support. Our clients, members and liquidity providers can continue to expect the highest levels of integrity, consistency, and trust from our team. Regarding volumes, March closed with market shares of 13% and 60% and daily volumes of 207k and 105k, respectively, for Euribor and ESTR Futures.

Credit - The team has done a stellar job of nurturing this segment. Launching USD EM and GBP underlyings enabled the team (Leon and Davide) to increase the level of material interaction with end clients. This had a big impact (positive) on client readiness. What is really encouraging is the diversity of users and the material increase in end clients trading directly in the order book resulting from the growing number of Liquidity Providers now active in the product suite. We will launch USD benchmarks, which the team and I are genuinely excited about. We feel this will propel the growth within the sector and see this as a major driver of growth in the next years. Overall, March has seen EUR 2.8bn and EUR 1.5bn in notional size trading in Euro Investment Grade and Euro High Yield index futures. We also saw the first block trades in USD EM Sovereign index futures, which now count an open interest of over 2,000 contracts and an overall traded Notional of about USD 100mn since their launch in February.

FX - FX is a segment where we play the long game; we slowly see the fruits of this approach. Volumes are 16% up YoY. One of the drivers behind this was the activation of new buy-side clients. We saw our OI increase by roughly EUR 2bn after the roll to a new record high of EUR 8.2bn. The client engagement has never been so high, with a full onboarding pipeline for Q2 that will further accelerate our volume and OI growth in 2024. We expect to increase the daily activity in Q2 with the introduction of a new LP scheme.

Looking ahead, Q2 will be busy for the team, and we are committed to maintaining our focus on our customers. This is, after all, a customer-driven business. Our relationships with our members are central to our success, which, in turn, is their success. We aim to grow together and continue learning from our members and clients. This is important to me because we don’t know everything, and learning keeps the team humble. The pipeline of initiatives for Q2 also remains deep. Hence, our clients have a lot to look forward to. Lastly, but by no means least, thank you to our colleagues for their support in helping the team bring products to life; you are integral to what we want to achieve as a group.