EurexOTC Clear Releases

Overview of content

EurexOTC Clear Release 16.0

With the EurexOTC Clear Release 16.0, Eurex Clearing introduced the following enhancements:

- Introduction of OIS on DKK-DESTR (Denmark Short-Term Rate)

- Automated Position Offset Function through Trade Entry API

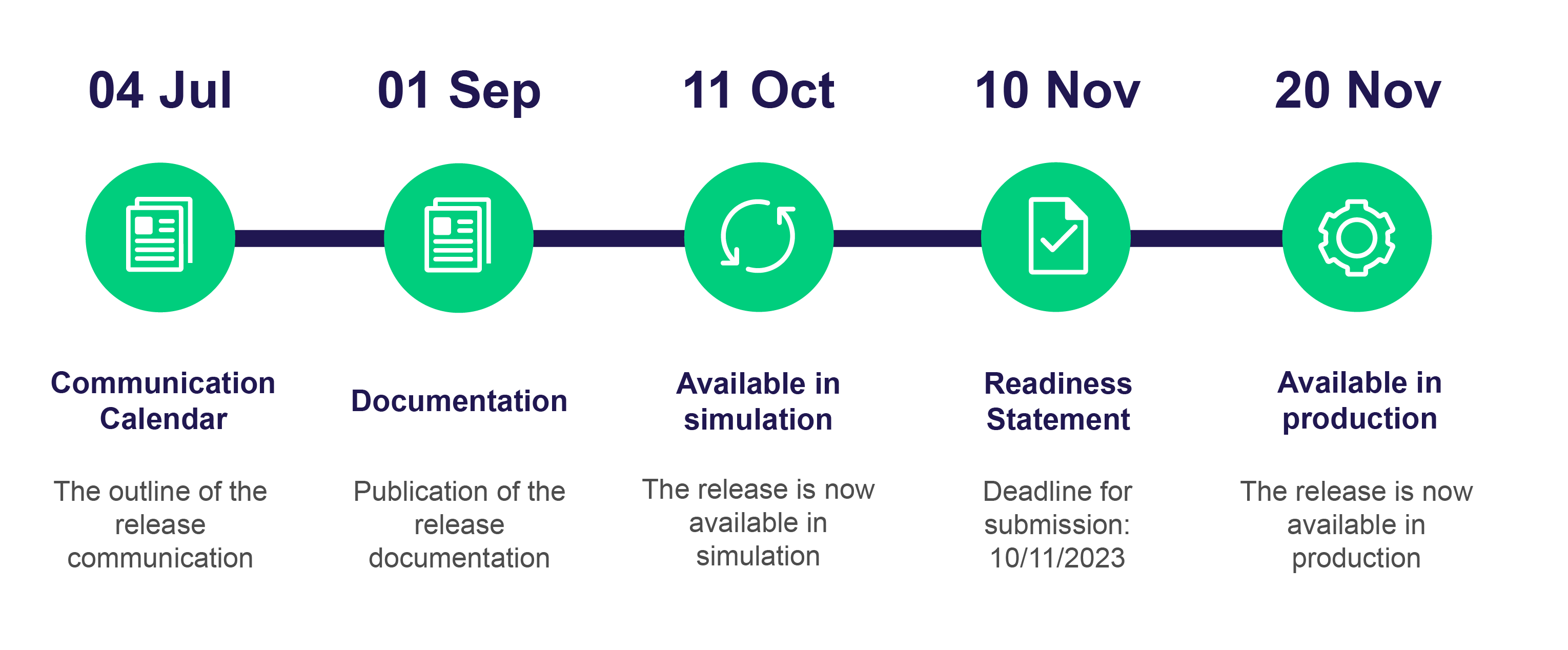

Simulation start: 11 October 2023

Production start: 20 November 2023

System Documentation

The OTC system documentation are stored in the Member Section under the following path: Resources > Eurex Clearing > Documentation & Files > EurexOTC Clear > System documentation.

- Focus Call - Presentation

September 2023

Circulars

Circulars

- Eurex Clearing Circular 078/23 EurexOTC Clear: Production launch announcement of EurexOTC Clear Release 16.0

- Eurex Clearing Circular 047/23 EurexOTC Clear: Introduction announcement of EurexOTC Clear Release 16.0

Newsflashes

- Eurex Clearing Readiness Newsflash | EurexOTC Clear Release 16.0: Additional documentation available

- Eurex Clearing Readiness Newsflash | EurexOTC Clear Release 16.0: Readiness Statement submission

Focus Days

Cross-margining Focus Day

- 30 October - 03 November 2023

FAQ

Please note that in case of full netting only once the fee is settled, the submitted offsetting trade would be eligible for netting.

The new Netting parameters will not affect the usual netting process. These are only new parameters introduced in the Netting Parameter window, the population of which will affect the value of Source System Client ID or Source System CM ID of the netted trades. If a dedicated account parameter is set to Y, the Source System Client and / or CM ID should be populated with the same value as the Source System Client and / or CM ID on the gross trade having the lowest CCP Trade ID (or Netting ID). If set to N, on the netted trade the Source System Client and/or CM ID will be empty.

The new UPI field will be available between ISIN and the CFI columns. For more information, please refer to the Report Manual for EurexOTC Clear Release 16.0.

Regarding EMIR reporting, Eurex Clearing will be primarily reporting the ISIN for OTC trades. In case the transaction has no ISIN, Eurex Clearing will report the UPI.

The availability of the UPI field in UAT environment is foreseen for 11 October, with the start of simulation. However, this functionality will be available only if the UPI information is provided by Approved Trade Sources in trade submission messages. Starting from January, Eurex will start populating the UPI field for every received trade even if this information is not provided by ATS.

Readiness Videos

Frozen Zone

Simulation

- 05.10. - 12.10.2023

Production

- 16.11 - 21.11.2023

Release Items/Participants Requirements

Feature/Enhancement | Details | Action Item |

Introduction of OIS on DKK-DESTR (Denmark Short-Term Rate) | Clearing of OIS (Overnight Index Swap) trades on the Danish DKK-DESTR (Denmark Short-term Rate) index will be introduced with maturities of up to and including 11 years supported. | Clearing Members, who want to clear this product, need to evaluate the impact on their side. If further assistance is required, please contact your Clearing Key Account Manager or client.services@eurex.com |

Automated Position Offset Function through Trade Entry API | The automation of position offset function will be introduced allowing clients to send a request via Approved Trade Source (ATS) and receive the trade economic details of their open trades at Eurex which they wish to offset by sending corresponding offsetting trades. | With the go-live, this functionality will be enabled by default for all Clearing Members and their clients. |

Introduction of Trade Refactoring Compression | TriOptima portfolio compression services will be enhanced to support Trade Refactoring compression algorithm allowing the residual trades with not only the changes in trade revision (notional, coupon, spread, direction), but also changes in the start and the end date of the trade. | There is no action required. |

A new field 'UPI' for OTC trades | The new optional field 'UPI' will be introduced, which will be provided by Approved Trade Source (ATS). Eurex will include the field information in Trade Notification messages and reports with the format of 12-character alphanumeric code. This field will result in changes to EurexAPIXML XSD and Report XSDs. | Clearing Members should evaluate the impact of consuming new trade notification messages and member reports. |

Report Changes | The following report changes will be made in the reports of EurexOTC Clear:

| We kindly ask all Eurex Clearing Members to ensure that the relevant report changes are reflected in their internal processes. |

GUI Changes | The following enhancements will be implemented in MC GUI:

The following enhancements will be implemented in OTC GUI:

| With the introduction of two account parameters in the netting Parameter window, the new fields will be set to “Y” by default. The clearing members can disable the parameters if they wish so. There is no other action required for GUI changes. |

API Changes | The following enhancements will be implemented in API modules:

| We kindly ask all Eurex Clearing Members to ensure that relevant API changes are reflected in their internal processes. |

CRE

The CRE is Eurex Group’s central solution for reports. The CRE allows a greater flexibility and meets the needs of today’s high frequency.

Eurex Initiatives Lifecycle

From the announcement till the rollout, all phases of the Eurex initiatives outlined on one page! Get an overview here and find other useful resources.

Further information about EurexOTC Clear can be found here.

Are you looking for information on a previous initiative? We have stored information about our previous initiatives in our Archive for you!

Contacts

Eurex Frankfurt AG

Customer Technical Support / Technical Helpdesk

Service times from Monday 01:00 – Friday 23:00 CET

(no service on Saturday and Sunday)

T +49-69-211-VIP / +49-69-211-1 08 88 (all)

Eurex Frankfurt AG

Key Account Management

Service times from 09:00 - 18:00 CET