Uncleared Margin Rules

In response to the global financial crisis of 2008-2009, the G20 nations agreed to a financial regulatory reform agenda covering the over-the-counter derivatives markets and market participants. Among them were recommendations for implementing additional margin requirements for non-centrally cleared derivatives – also known as the Uncleared Margin Rules (UMR).

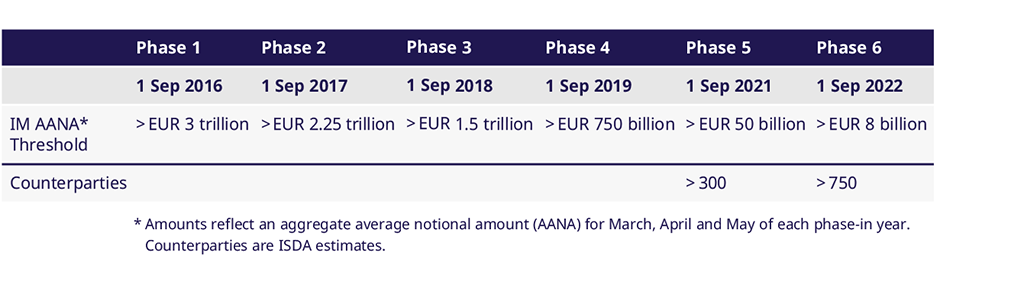

UMR impacts many market participants such as asset managers, hedge funds, corporates and pension funds: With phases 1-6 of UMR now in effect, firms with an Average Aggregate Notional Amount (AANA) greater than EUR 8 billion are required to post initial margin bilaterally with their counterparts.

By looking at the Average Aggregate Notional Amount (AANA) holistically, market participants can decide which products and services are the best fit to optimize UMR-based margin requirements:

- By centrally clearing in-scope trades at Eurex Clearing, you can remove transactions from your AANA calculation.

- By substituting your uncleared OTC derivatives for exchange-traded derivatives at Eurex, you can also remove trades from the scope of your AANA calculation.

- Using our Compression Service in cooperation with TriOptima or Capitalab, you can reduce your overall gross notional and the number of OTC derivatives trade lines, thereby lowering your AANA exposures.

UMR product scope

Which derivatives count towards my AANA?