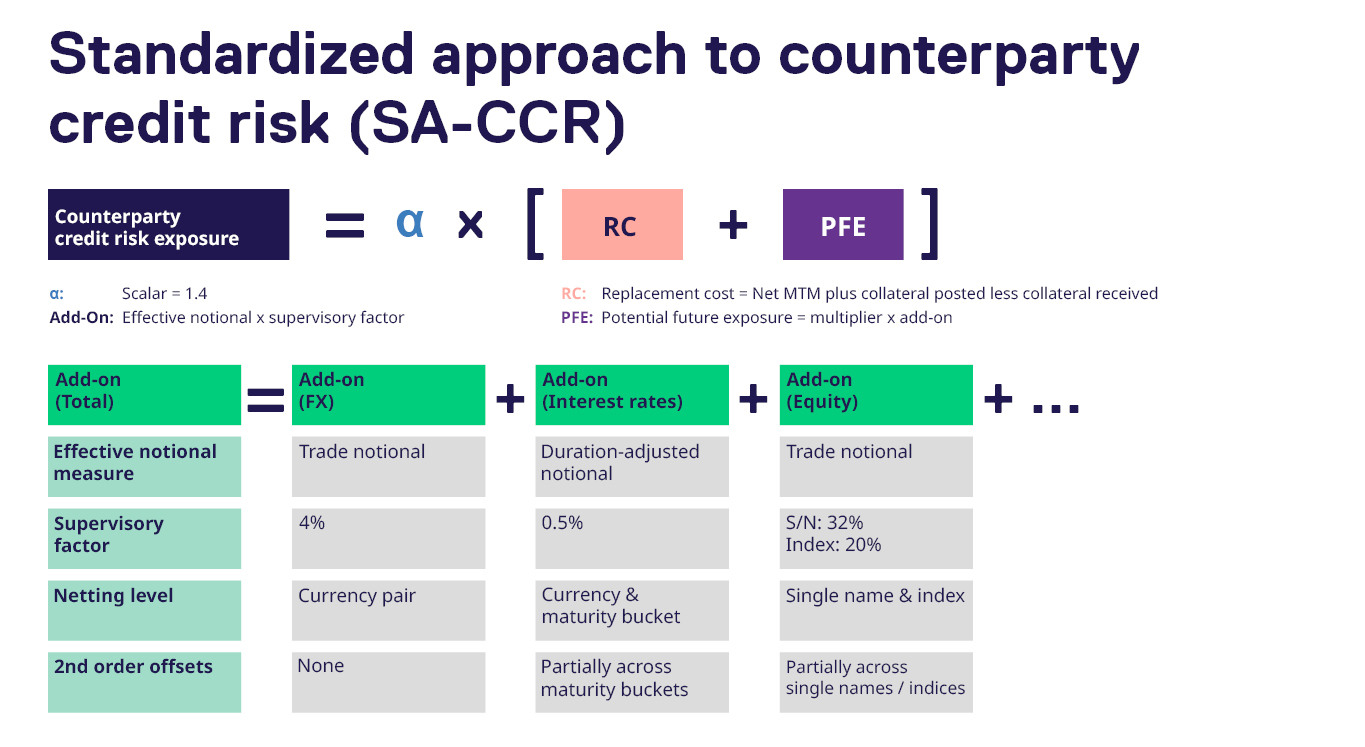

SA-CCR

Historically, banks preferred to use internal models to calculate regulatory capital requirements, allowing for a closer alignment between risk management and capital allocation. As regulators grew increasingly skeptical of the utility of internal models, backstops such as the Standardized Approaches for Risk Weighted Assets (RWAs) and the Leverage Ratio (LR) were put in place. The Standardized Approach to Counterparty Credit Risk (SA-CCR) is applied in these backstop measures for derivative exposures. SA-CCR has now been implemented across most jurisdictions. The methodology has improved risk sensitivity compared to previous supervisory methods, meaning that there will be winners and losers. SA-CCR delivers benefits for banks with balanced portfolios with individual counterparties, while those with directional counterparty portfolios are heavily penalized.

SA-CCR is only directly applicable to banks and other institutions supervised under prudential regulation. The buy side is impacted indirectly, as the banks who provide the liquidity to the buy side have to manage their derivative portfolios under the new regime. This can lead to higher costs for the buy side, including transaction costs/pricing (i.e., bid/offer) and/or higher funding and liquidity costs through (voluntary or mandatory) collateralization requirements.

Central clearing offers several advantages for banks, including:

- Beneficial risk weights – centrally cleared derivative trades with Eurex qualify for beneficial risk weights, which can be as low as 2%.

- Multilateral netting – by moving multiple bilateral OTC relationships to central clearing, the netting efficiency increases exponentially.

- Settle-to-market (STM) – STM accounting treatment is available for centrally cleared portfolios, and an assumption of daily settlement materially reduces potential future exposure.

In addition to the above, Eurex offers some exchange-traded derivative (ETD) alternatives to OTC derivatives. There are lower margin requirements for ETD, compared to their OTC derivative equivalents, due to lower margin period of risk (i.e., liquidation period) assumptions.

Using ETD and cleared OTC derivative alternatives could be part of an effective bank capital management strategy addressing SA-CCR and UMR with follow-on benefits for the buy side.

Calculating SA-CCR