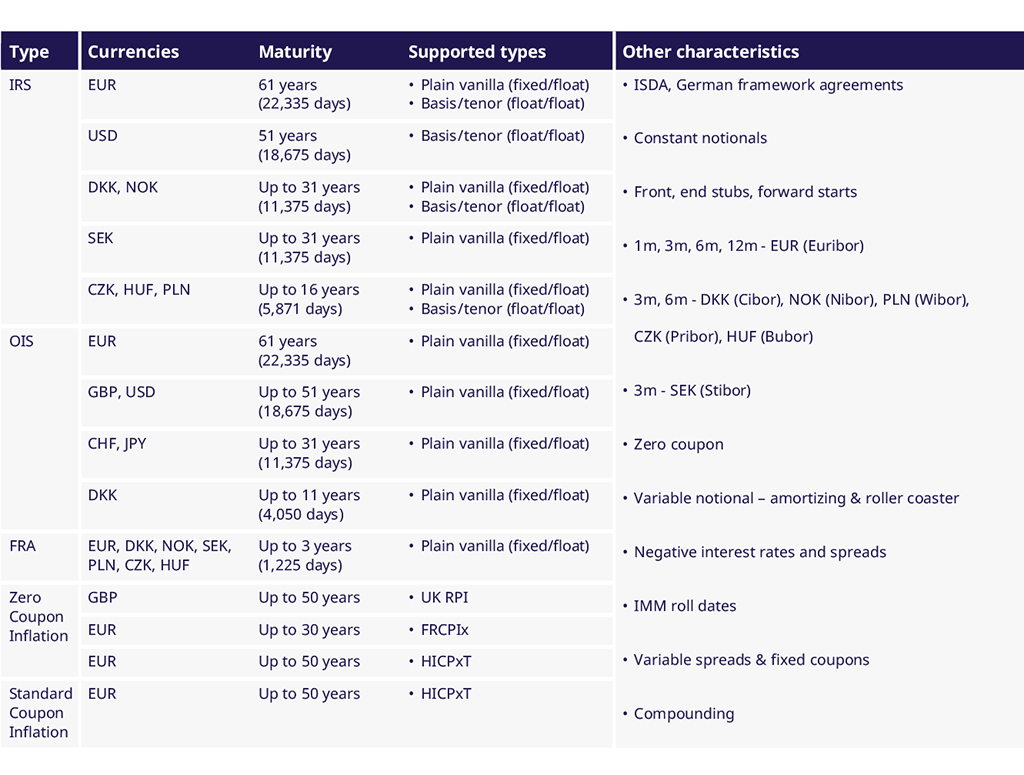

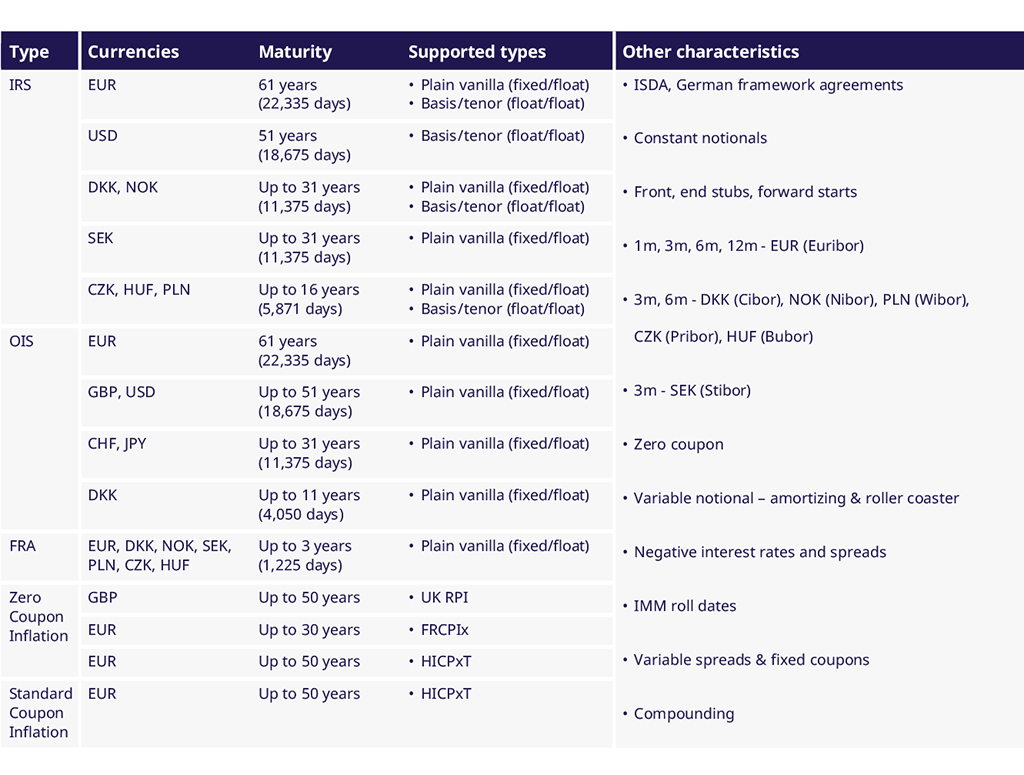

We offer clearing for OTC Interest Rate Swaps as well as Inflation Swaps. By clearing both through EurexOTC Clear, clients can benefit from significant margin offsets where there are correlated risk reductions.

Contacts

Danny Chart T +44-20-78 62-72 57 |

Milena Dimitrova T +44-20-78 62-70 79 | Stefan Ullrich T +65-65 97-30 79 | Laurent Partouche T +1-212-309-93 06 |