Segregation Models Support

The main reason for segregation is the separation of positions and collateral in case of a Clearing Member default. Eurex Clearing offers a variety of Segregation Models to address the needs for segregation of different client types.

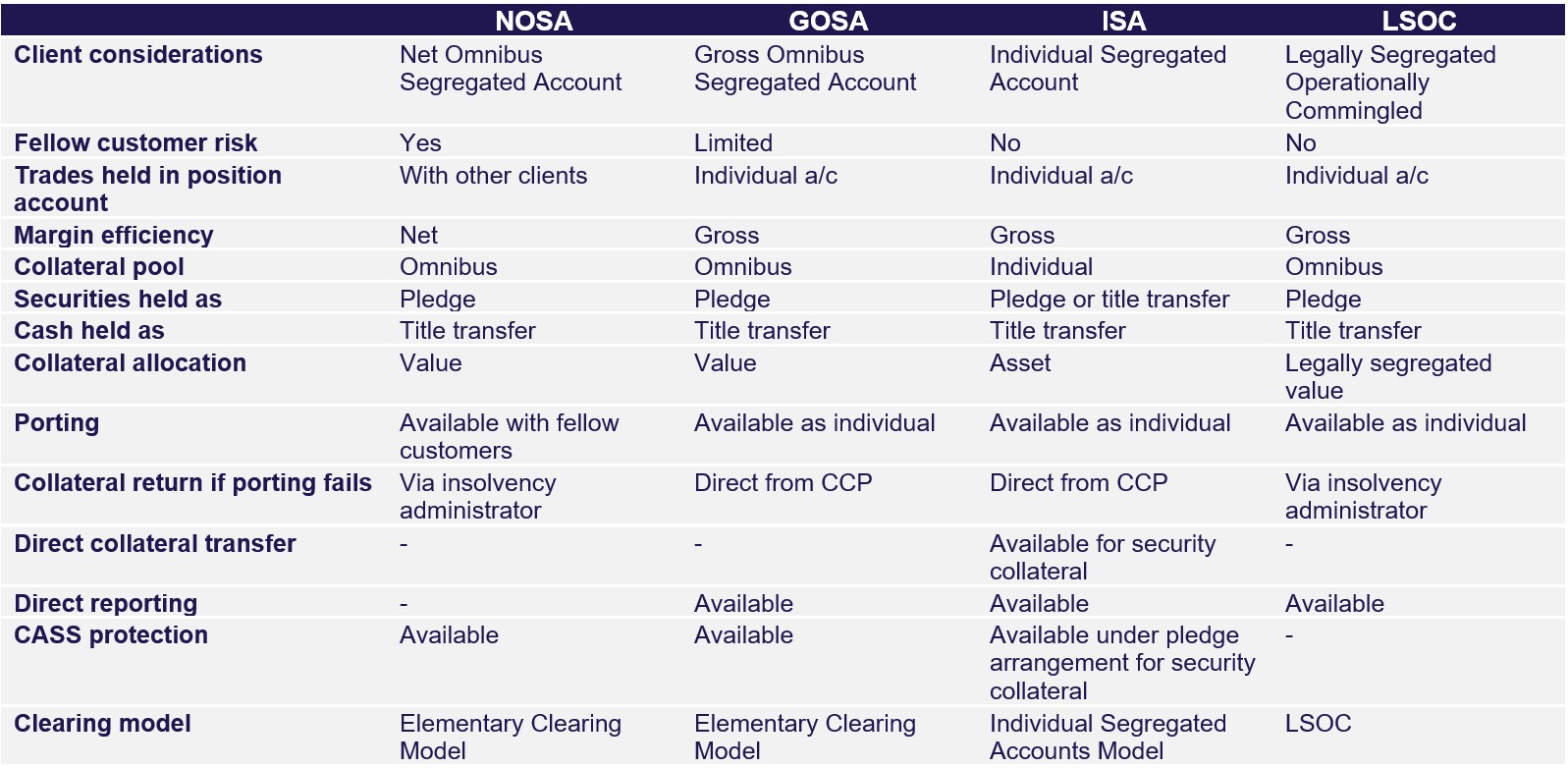

There are different types of accounts and segregation types:

Under European framework (EMIR):

- Net Omnibus Segregated Account (NOSA)

- Gross Omnibus Segregated Account (GOSA)

- Individual Segregated Account (ISA)

Under US framework:

- Legally Segregated Operationally Commingled (LSOC)

The main criteria to decide on the required level of segregation are:

- fellow customer risk sharing or not

- separate Collateral Pool desired or not

- Margin efficiencies net or gross

Clients should contact their Key Account Managers or client.services@eurex.com and clarify, which Segregation Models fits best to their needs. For more details please refer to: Client Asset Protection.

FAQ

- Net Omnibus Segregated Accounts have the highest Margin efficiency stemming from the fact that positions of several clients are commingled and netted within one account.

- However, this Segregation Model also incurs the highest fellow customer risk.

- Individually Segregated Accounts have no fellow customer risk as both the positions and the assets of the client are separated from both Clearing Member's assets and other clients.

- Gross Omnibus Segregated Accounts offer only a limited protection from fellow customer risk as the Collateral Pool is shared with other clients.

- Client Asset Protection (CAP) under EMIR service of Eurex offers the possibility for clients to port to a Replacement Clearing Member and continue clearing activities even after their Clearing Member defaults.

- Service is available for both:

- Omnibus Segregation

- Individual Segregation

- For more information please visit our homepage: Porting under EMIR.

- Please contact: Group Client Services, Trading & Clearing and Cash Market

- E-Mail: client.services@eurex.com

- Phone: +49-69-211-1 17 00

- Porting to a Replacement ‘Futures Commission Merchant’ (FCM) Clearing Member is also possible for 'Legally Segregated, Operationally Commingled' (LSOC) US-Clients.

- For more information please refer to our homepage: Porting under LSOC.

- The Fund Manager (Authorized Manager) solution allows a fund specific position account set-up in an operationally efficient manner and is available for all Segregation Models of Eurex.

- In general, all position accounts are set-up to separate each relevant fund which is disclosed to the Central Counterparty (CCP).

- The Clearing Member can optionally select for its Fund Manager a set-up of multiple transaction accounts in a single risk netting unit.

- For more detail please contact your Key Account Manager or client.services@eurex.com.

- For more detail please refer to our homepage: Fund Manager set-up.

- ISA Direct Model combines elements of a direct clearing membership and the traditional service relationship in client clearing - tailored specifically for the buy side.

- It opens up a new principal client relationship between buy side clients and the CCP, with the regular Clearing Member acting as a ‘Clearing Agent’, providing a variety of mandatory and optional service functions.

- Please contact: Fixed Income, Funding & Financing Sales

Frankfurt: Phone: +49-69-211-138 59

London: Phone: +44-20-78 62-72 76

E-Mail: FixedIncome.Sales@eurex.com

For more information please refer to our homepage: ISA Direct.

Supporting Documents

Download the Cheat Sheet Segregation Model

Contact us

Eurex Frankfurt AG

Key Account Management

Service times: Monday to Friday 09:00 - 18:00 CET