Delivery management

Delivery management at Eurex Clearing is processed in C7 SCS for all transactions involving CCP-eligible instruments concluded at the Frankfurt Stock Exchange (MICs: XETR and XFRA) and for all physical deliveries out of Eurex Deutschland (MIC: XEUR) settling at Clearstream Europe, SIX SIS, EUI (CREST), ESES, or Euronext Securities Milan (ES-Milan) as well as for Repo transactions. Eurex Clearing offers Trade Date Netting (TDN) as the supported netting model with C7 SCS for all transactions concluded at the Frankfurt Stock Exchange and for all physical deliveries out of Eurex Deutschland, whereas Settlement Date Netting (SDN) is the mechanism offered with C7 SCS for Repo transactions.

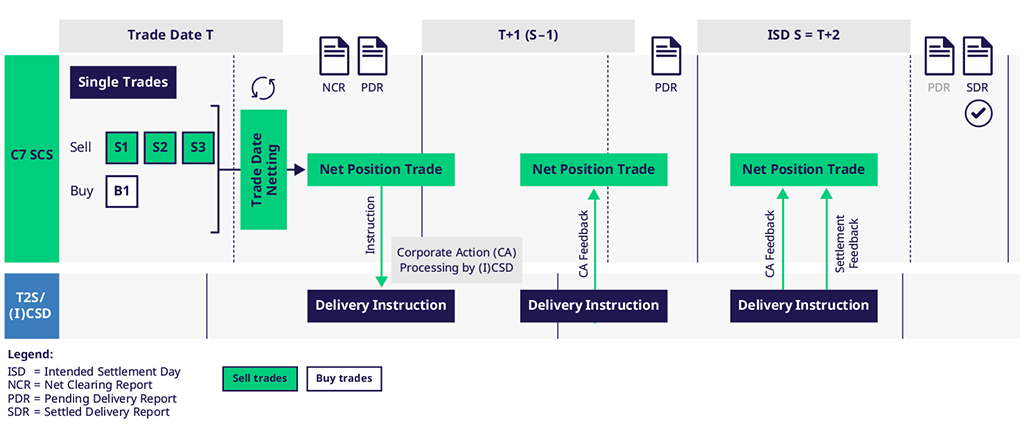

Trade Date Netting (TDN) is the mechanism offered with C7 SCS:

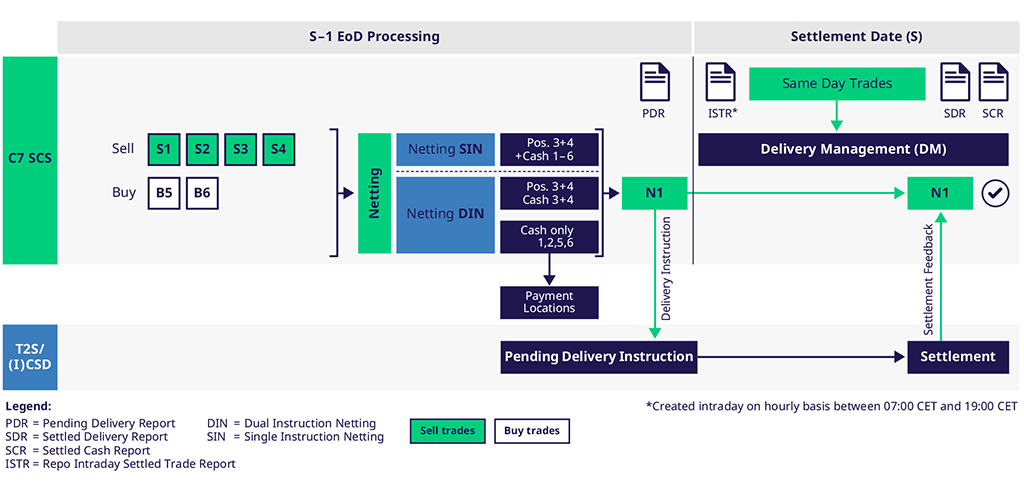

Settlement Date Netting (SDN) is the mechanism offered with C7 SCS for repo transactions:

Failure handling

We are aware that things do not always run smoothly. As one of the world's leading CCPs, we provide efficient solutions to help you when this is the case.

Our failure handling procedure includes measures to accommodate late delivery processing as well as a buy-in and cash settlement models.

Contact

Eurex Clearing AG

Clearing Business Relations