Default Fund Support

What is the Eurex Clearing Default Fund?

- The Default Fund is a part of the ‘Default Waterfall’ (‘Lines of Defense’).

- The Lines of Defense ensures loss coverage in normal and extreme market conditions.

- In case of a Clearing Member default, Eurex Clearing primarily uses the financial resources (its Margin Collateral) provided by the defaulted Clearing Member to cover resulting losses. If the defaulted Clearing Member’s resources and Eurex Clearing 'Dedicated Amount' (‘Skin in the game’) are insufficient, also non-defaulted Clearing Members’ contributions to the Default Fund are utilized.

- If the SITG is insufficient to cover all remaining losses, non-defaulted Clearing Members’ contributions to the Default Fund and “Second Skin in the Game” of Eurex Clearing (SSITG) are utilized.

- With respect to the ISA Direct Clearing Model, if the Default Fund contributions of a defaulted ISA Direct CM do not cover all losses, remaining claims have to be covered first by the Clearing Agent by providing up to two times of the Default Fund contribution of the defaulted ISA Direct CM (Assessment ISA Direct CM) following by the remaining layers of the default waterfall.

- In case of ISA Direct Indemnified Clearing Model, the Indemnifying Clearing Agent provides Indemnity which covers all liquidation and default management costs that exceed the defaulting ISA Direct Indemnified CM’s margin and Default Fund contribution in a default scenario of an ISA Direct Indemnified CM.

- There is one joint Default Fund, covering all asset classes cleared by Eurex Clearing.

How is the Default Fund calculated?

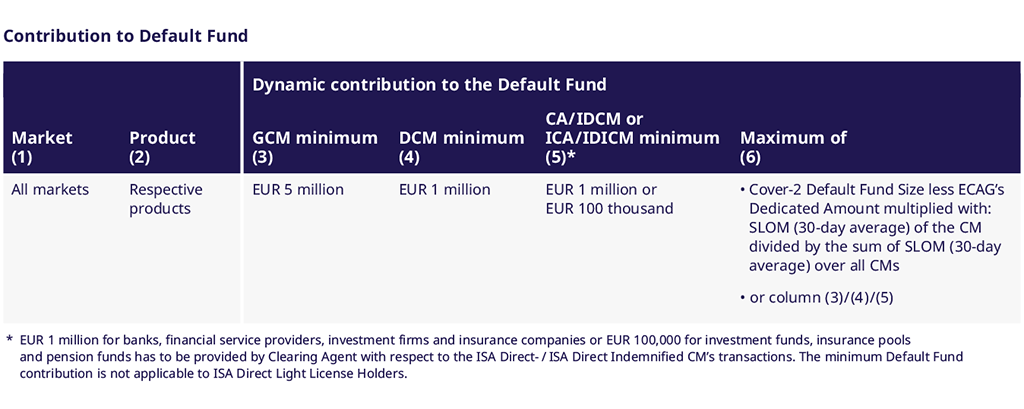

- Every Clearing Member is required to contribute to the Default Fund. Each contribution depends on the relative risk exposure.

- The Default Fund is calibrated to cover all losses resulting from a simultaneous default of Eurex Clearing largest two Clearing Members with a confidence level of 99.9%.

- The Default Fund Requirement is re-calculated in EUR on a monthly basis (per ultimo).

- The Collaterals (Cash, Securities) for the Default Fund Requirement are evaluated daily.

- In case of ISA Direct Clearing Model, the Clearing Agent1 covers the Default Fund contribution of the ISA Direct Clearing Member2.

For further details on the default fund calculation, please refer to Default Fund.

In which report can I find information on the Default Fund?

- The Default Fund composition is shown in the Report CD090 (‘Overall Asset Summary’).

- The Default Fund contribution related to Clearing Agents activities for ISA Direct Clearing Members are displayed in the report CD091.

- The CD092 report gives an aggregated overview about requirements and coverages resulting from both Clearing Member role and Clearing Agent role. Its detailed breakdown is provided in reports CD090 /CD091.

The reports are distributed daily to the Common Report Engine, which is Eurex Clearing Group’s central solution for trading and clearing report retrieval. Further details are available here: User Guide.

The report description is shown in the following document: Eurex Clearing Prisma / Report Reference Manual. The document is available in the Member Section via the following path: Resources > Eurex Clearing Documents > Eurex Clearing Prisma > Release Documents > Document and Circulars.

The Default Fund Requirement for Legally Separated Operationally Comingled (LSOC) Clearing Model is also captured separately.

The Default Fund Requirement is displayed on Clearing Member level and in EUR.

1 The term Clearing Agents also comprises Indemnifying Clearing Agents.

2 The term ISA Direct Clearing Members also comprises ISA Direct Indemnified Clearing Members.

Where can I find more information about the Default Fund?

Website

For further information please visit the following websites:

Clearing Conditions

Additional information can be found in the Eurex Clearing - Clearing Conditions: Chapter 6: Default Fund.

Circular

For further information on the Default Fund, please refer to the Eurex Clearing circulars:

Supporting Documents

Contact us

Eurex Clearing AG

CCP Risk Management / Risk Exposure Management

Service times: Monday to Friday 01:00 – 22:30 CET

T +49-69-211-1 24 52

Eurex Clearing AG

Helpdesk Derivatives Clearing

Service times: Monday to Friday 01:00 – 22:30 CET

T +49-69-211-1 12 50