Stress scenarios and exposure aggregation

Stress scenarios are created for each asset class (Liquidation Group) by shifting relevant risk factors in the particular market. The shift size accounts for the assumed stress period of risk of the corresponding liquidation group. As different Liquidation Groups have different risk characteristics, this stress period of risk is consistent with our Default Management Process for the respective Liquidation Group.

The stress scenarios used for the Default Fund dimensioning are calibrated to be regarded as extreme but plausible. Additional scenarios, solely for analysis purposes, can be even more extreme and potentially not plausible. Due to different constellations of portfolios across Clearing Members, some portfolios may be more impacted while other portfolios may be less impacted by a specific scenario.

Therefore, different types of stress scenarios (historical or hypothetical) are in place to reveal the risk exposures under stressed market conditions of all Clearing Members.

Historical scenarios represent extreme, correlation break events, and globally significant market occurrences. Historical scenarios are derived by evaluating the empirically observed returns during the designated stress period of risk for benchmark risk factors across all asset classes.

Historical scenarios are regularly reviewed using quantitative and qualitative analyses, taking into account the materiality of the cleared products. The shifts used for these scenarios are the empirically observed returns that occurred around the respective date over the stress period of risk. For example, historical scenarios include the following events:

- DAX Crash (1989)

- Lehman Default (2008)

- Cyprus Crisis (2013)

- Covid Pandemic (2020)

- Replay SVB Crisis (2023)

Hypothetical scenarios are designed to account for the largest risk factor movements over the stress period of risk with a confidence level of 99.9 percent. These forward-looking scenarios simulate extreme risk factor movements for all cleared asset classes and products simultaneously by combining selected constellations of up and down moves across asset classes. However, the scenarios are kept plausible by adhering to consistent risk factor movements and pricing principles within each asset class. For example, simulating a downturn of all single stocks and a simultaneous upturn of equity indices would not be considered as a plausible event.

There exist two different types of hypothetical scenarios, which can be distinguished by the type of shift:

- Relative shifts: These move the corresponding risk factor by a fixed percentage (e.g., 15%) of its current value. These shifts are independent of market volatility and depend solely on the current market value of the risk factor.

- σ-multiplier shifts: These move the corresponding risk factor by a relative value that depends on the current volatility level of the risk factor.These shifts incorporate volatile market conditions, such that the magnitude of the shift increases when volatility increases.

In addition, absolute shifts are used for interest rate products to adequately cover low interest rate environments.

Correlation stress scenarios are special hypothetical scenarios that additionally stress the correlations between single risk factors. Stress scenarios designed on asset class level imply high correlations between risk factors when shifting them in the same direction and with the same magnitude. By relaxing the assumption of parallel shifts – direction and/or magnitude – additional hypothetical scenarios that stress the correlation are introduced.

To cover the material correlation breaks across the universe of risk factors with a manageable number of scenarios, the dimensionality of the risk factor universe is reduced by:

- Aggregation of stress figures across asset classes: First, for each member portfolio, asset classes are treated separately and the corresponding risk factors are shifted individually both up and down. Afterwards, the results for the worst case per asset class are again aggregated within each portfolio. This process generates conservative results for each portfolio as historical correlations between different asset classes are intentionally disregarded.

- Identification of material products inside asset classes: Correlation stress scenarios within one asset class are defined by shifting material products differently to the general market movement. Material products are identified by their share of open interest within their asset class. Spreads, twists and butterflies may simulate suitable moves of risk factors for term structures or implied volatility grids.

Global scenarios aim to condense the information from a large number of asset class-specific forward-looking hypothetical scenarios into a smaller number of concise scenarios. Hence, these scenarios can also be interpreted as economic scenarios.

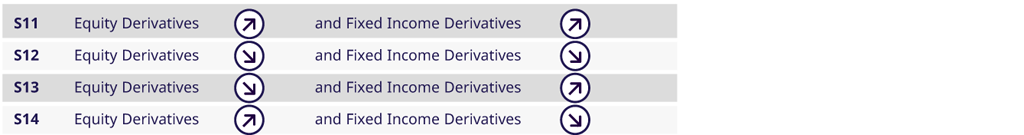

The set of global scenarios is determined by combining possible price movement directions of the most material asset classes, which currently are Equity Derivatives and Fixed Income Derivatives.

For example, when combining equity price up-movements and fixed income price up-movements (see scenario “S11” in the illustration), only those stress scenarios are considered for the worst-case scenario determination that assume an up-movement of equity prices. The same holds true for fixed income scenarios.

For other, not material, asset classes, e.g. commodities or properties, all movement directions are considered for the worst-case scenario determination. This means, for one portfolio it may be a commodity price down-movement, while for another portfolio it may be a commodity price up-movement, although both portfolios are in the same global scenario. By this means it is ensured that the most conservative outcome is realized for each portfolio.

Market liquidity stress simulates low market liquidity under extreme market conditions and estimates potential additional losses during liquidation. In particular, the initial margin components that account for market liquidity risks are stressed by assuming stronger adverse price moves than considered within margining. The stressed margin component is counted as additional stress loss on top of all historical and hypothetical scenarios.

Analysis scenarios: Besides the above mentioned, additional scenarios solely for internal analysis purposes are available. These scenarios are predominately used to analyze member portfolios for risk constellations and effects, which go beyond the purpose of Default Fund dimensioning.

Key stress testing metrics: Stress scenarios are based on risk factor movements and translate potential impacts of severe economic developments into monetary figures. This process yields a new product value, called stressed value, using the scenario-specific risk factor values. The difference between the stressed value and the current value can therefore be defined as the stress P&L of a product in a given scenario:

Stress P&L = Stressed value - Current value

Collected margin to cover potential future losses can be deducted from the stress P&L and ultimately yields the stress shortage/surplus:

Stress shortage (or surplus) = Stress P&L + Margin

By using the Total Margin Requirement (TMR) to derive the stress shortage (or surplus) metric, we conservatively anticipate a potential withdrawal of excess collateral (over-collateralization) in stressed market conditions. This metric is used in the Default Fund dimensioning process.

To estimate the potential credit exposure on Clearing Member level in extreme but plausible market conditions, risk figures from position level are aggregated across all related sub-portfolios. Additionally, stress results are calculated on corporate group level for the worst-case scenario. While aggregating stress figures along accounts, members and groups, both global scenarios as well as historical scenarios are taken into consideration.

This risk aggregation accounts for the relevant aspects of the segregation models and the Default Management Process:

Stress figures of a stress scenario are netted:

- within the Clearing Member’s proprietary risk account subject to the Elementary Clearing Model,

- across all risk accounts within each omnibus client pool subject to the Elementary Clearing Model,

- across all risk accounts within each omnibus client pool subject to the Net Omnibus Clearing Model,

- across all risk accounts of each individually segregated Non-Clearing Member or Registered Customer subject to the Individual Clearing Model, and

- across all risk accounts of each ISA Direct pool subject to the ISA Direct Clearing Model.

- For Gross Omnibus Segregated Accounts (GOSA) a difference claim is calculated for each Non Clearing Member, Registered Customer or single client in an A-account and hence stress losses are not netted within the collateral pool to which the respective client belongs.

- In order to respect client asset segregation, stress surpluses of client pools are not netted with stress shortages of other pools of the Clearing Member.

- A stress surplus that is stemming from a Clearing Member’s proprietary business can be used to reduce stress shortages from its client business.

- Stress scenarios that are applied on corporate group level assume that all Clearing Members within the same group are subject to the same scenario. This in turn means that the worst-case group scenario may not necessarily be the worst-case scenario for each individual Clearing Member in the group. In addition, stress surpluses on Clearing Member level cannot be used to offset stress shortages of other Clearing Members within the corporate group under the same scenario.

Stress shortage/surplus figures are available for all stress scenarios per Clearing Member and corporate group. For each group, the worst-case scenario can be determined as the scenario with the largest stress shortage. This result is the estimated credit exposure of a group which is considered in the Default Fund dimensioning process.