Mar 31, 2017

Eurex Clearing

Part 1: Spotlight on initial margins and other default resources

Pioneering CCP Transparency Series

The Public Quantitative Disclosure (PQD) is an internationally agreed format defined by CPMI-IOSCO with the intention of enhancing CCP market transparency.

Together with publically available market data information and CCP rulebooks, that outline the relationship between a CCP and its participants, the PQD enables regulators, market participants, academics and the public to gauge, compare and evaluate centrally cleared markets, CCPs systemic importance and their respective risk management standards.

Eurex Clearing has published its PQD since 2015 and continuous strongly to support transparency, both for market stability reasons as well as enabling the challenge and support of centralized risk management.

The CPMI-IOSCO format is comprehensive, and the more than 200 data fields delivered every quarter in arrears format require some digestion.

With the latest disclosure, published with an agreed three-month delay, Eurex Clearing now begins a series of commentary to highlight key trends, discuss current topics and to shed some light on selected data points.

Spotlight on initial margins and other default resources

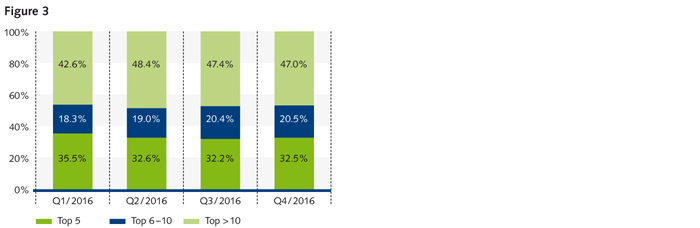

As a CCP, Eurex Clearing guarantees the fulfilment of every transaction in every market for which it provides clearing services. While the mainstay of this safety system is the initial margin, the lines of defense include several additional layers of financial resources, including the pre-funded default fund.

About 80% of the overall financial resources constitute initial margins. In case of a default, only the defaulters margins are used, non-defaulters margins are segregated.

In Q4/2016, client margins increased by 8.3% (from EUR 20.5 bn to EUR 22.2 bn), while house margins decreased by 2.7% (from EUR 14.0 bn to EUR 13.6 bn).

The so-called ‘Skin in the Game’ is a dedicated amount provided by Eurex Clearing as its own contribution to the default fund. It is utilized after the contributions to the default fund provided by the defaulted clearing member have been exhausted. If the ‘Skin in the Game’ is insufficient to cover all remaining losses, non-defaulted clearing members’ contributions to the default fund are utilized.

Eurex Clearing’s own contribution currently amounts to EUR 150 mn. We increased the ‘Skin in the Game’ by EUR 50 mn in Q2/2016. More recently, we further strengthened the lines of defense in Q1/2017 by adding another EUR 50 mn. Eurex Clearing provides a sizable contribution to the lines of defense, significantly more than the EMIR requirement (25% of the regulatory capital).

The default fund amounts to EUR 3.0 bn at the end of Q4/2016. It decreased by 8% on a quarter-to-quarter basis.

Assessments by clearing members are capped at two times the default fund requirement. Eurex Clearing contributes an additional maximum amount of EUR 600 mn under a letter of comfort provided by Deutsche Börse, where up to EUR 300 mn can be utilized simultaneously with the assessments on a pro rata basis.

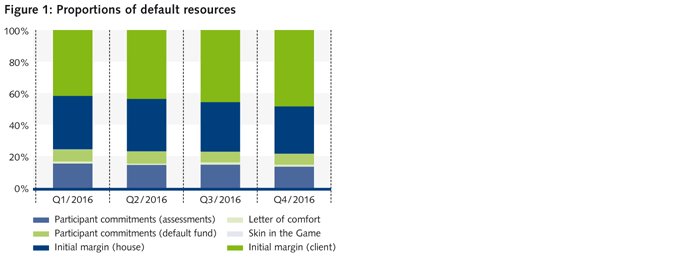

Eurex Clearing provides more transparency on initial margins than required by the PQD, as we break down the initial margin by Liquidation Group and Split where applicable. A Liquidation Group constitutes a collection of products that share similar risk characteristics. Portfolio margining is applied to products with the same holding period in a Liquidation Group Split. For products with different holding periods, margin offsets can be granted across Liquidation Group Splits within the same Liquidation Group. Listed fixed income derivatives and OTC IRS belong to the same Liquidation Group but different Liquidation Group Splits. The development of the different Liquidation Groups and respective Splits in Figure 2 sheds more light on the key changes in Q4/2016, where overall initial margins have increased by 3.9% from EUR 34.5 bn to EUR 35.8 bn.

As of end of Q4/2016, Equity Derivatives accounted for the largest initial margin share with approximately 50%, followed by Fixed Income Derivatives with 23% and OTC IRS with 7%. The remaining Prisma Liquidation Groups (Property Futures, Commodity Derivatives, Precious Metals Derivatives, Foreign Exchange Derivatives, IRS Constant Maturity Futures, Asian cooperations KOSPI/TAIFEX) show in total a contribution of below 1%.

GC Pooling, Special Repo, Securities Lending and other cash market products are margined under Risk-Based Margining (RBM) and make up the remaining 20%.

Figure 2 shows that the increase in margins can be mainly attributed to the larger exposure in exchange traded Fixed Income Derivatives, which experienced a 23% margin increase driven by larger volumes in Q4/2016.

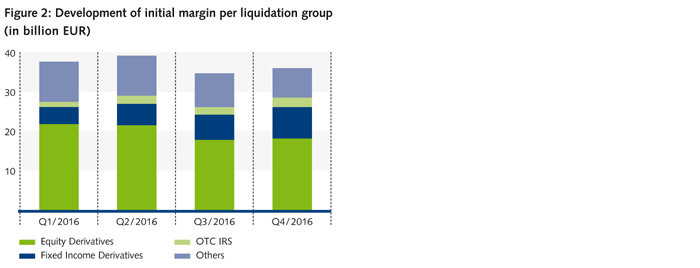

Figure 3 shows that concentrations in initial margins remained moderate and stable over time.

The aggregated margin requirement of the largest five/ten clearing members accounts for 32% / 53%. There are no material differences in the level of concentrations in the Equity Derivatives, Fixed Income Derivatives and OTC IRS Liquidation Groups.