The team continued to work hard to launch several initiatives in October, with launches in FX Emerging Markets Currencies and High Yield Credit Futures. FX and Credit are both exciting and important segments for the FIC business and the team remains focused on developing these into core markets. The High Yield futures has started positively with trades worth over EUR 10 million in notional value, negotiated in the order book within the first two weeks from launch. It is impressive and humbling to see the team working closely with all key stakeholders, partners, and colleagues to make this a success. We are committed to building a comprehensive, diverse, strategic portfolio where our products are fully fungible with trading and risk platforms. As we move into the final two months of the year, there will be many opportunities to build out these important segments, with increased impetus on end-client activation to ensure critical mass.

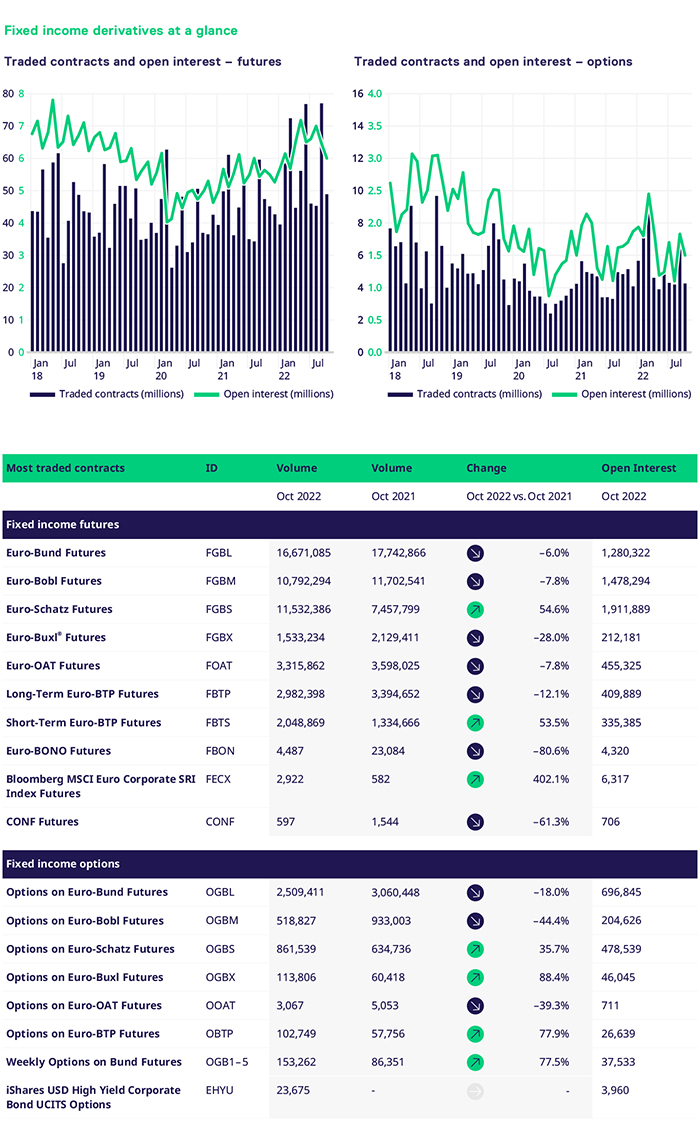

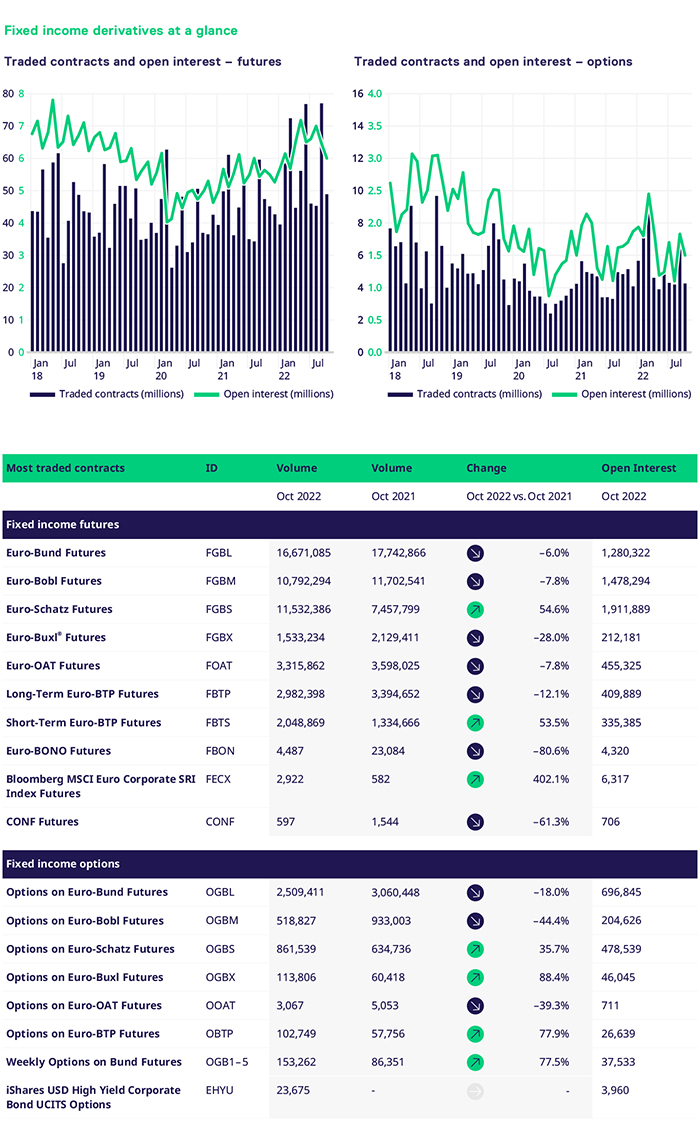

Volatility continued throughout October, albeit within tighter ranges than previous months. We saw raised volumes in certain pockets of the portfolio, which we expect to continue into year-end and early 2023. Futures volumes were modestly higher (+3.2%) than last year's period. Options volumes were 11.4% lower on a like-for-like basis versus 2021, but with green shoots in certain segments. Listed FX volumes enjoyed a strong month, seeing an increase of 151.4% versus October 2021. Liquidity remains challenging, with this being more of a collateral scarcity topic.

Broadley speaking, October proved to be a challenging month, but volumes were +1.8% higher, which, we feel, shows the portfolio's resilience. The front end consistently drew large increases in volumes in the futures space. The core German segment performed strongly in Schatz, underpinned by the macroeconomic backdrop. Schatz volumes were 54.6% higher, whereas the rest of the German segment saw declines of 6% (Bund), 7.8% (Bobl) and 28% (Buxl). Despite this, we did see over 40m contracts trade. The Italian segment continued to see positive momentum with volumes in the front end of the curve, seeing an increase of 53.5% versus Oct '21. The 10y saw volumes decline 12.1%. The French segment took respite with volumes 7.8% lower versus the same period last year. Having said this, last week, FI futures traded c2.5m contracts daily, which is 16.3% above the 2021 average.

As we move into the final two months, the macroeconomic backdrop still supports our portfolio. The German segment performance was mixed, with Bund options declining versus Oct '21, with c.2.5m contracts trading versus c.3m in October last year. On the other hand, weekly options on Bunds saw a significant increase in volumes of 77.5%. The front end saw a significant percentage increase, with Schatz 35.5% higher versus 2021. The belly underperformed, with volumes 44.4% lower. However, the long end saw volumes 88.4% higher compared to October 2021.

The French OAT saw volumes lower by 39.3% compared to last year. The Italian options BTP segment saw a material increase of 77.9%, trading c.102.2k contracts. The Italian segment performed strongly throughout 2022, with ADV levels significantly above 2021.

Moving away from core rates, the credit portfolio continues to build on the strong momentum of 2022. The Corporate Bond SRI Index futures traded over c.3k contracts and continues to see more active clients participate in the product. The recent moves in credit spreads and new client activation will further boost growth in the final months of 2022. ETF options continued to see pockets of liquidity, with volumes of c.23k across the high yield corporate bond underlying. This is an interesting segment we feel clients should look to more as we haven't seen a credit event yet, but it is possible for 2023.

In FX, we had another very solid month. This is still a nascent segment for Eurex but one we are committed to building it out. The team works closely with all parts of the ecosystem to position the business for accelerated growth in 2023. The portfolio saw volumes 151.5% higher versus the same period last year.

Even if the divergence in monetary policy remains unchanged for the foreseeable future, a consolidation of the main trends can be seen in October. The USD index has initiated a short-term downward movement since its high in September and was unable to break above the highs from September to October, with new short-term lows at the same time. Open interest remains high in this segment at c. 80,000 contracts (c.+152% YoY). Due to some upcoming client activation in the upcoming months, we are very confident that this segment will keep developing with significant growth rates in the near future.

As we move into the final months of 2022, I'd like to express my sincere gratitude to my team, our colleagues, clients, members, partners, and liquidity providers. Our results stem from our collective teamwork and efforts. We are committed to working tirelessly to ensure our newly launched products succeed, laying the foundations for a solid 2023. The team will announce further initiatives for early 2023 in the coming weeks, which we feel will enhance the portfolio further. Watch out for these announcements!