If there was any doubt about what a pivot from QE to QT feels like, then the second quarter provided all the empirical evidence. Perhaps the speed at which central banks have felt forced to become so hawkish on interest rate policy has caught the market off-guard. With both global equity and fixed income markets hit hard, we are reminded that ZIRP isn't the norm but the exception. Of course, there has been a tragic catalyst in the form of the ongoing Ukraine war. I hope for a negotiated peace well ahead of year-end to avoid a ground war continuing into the harsh winter.

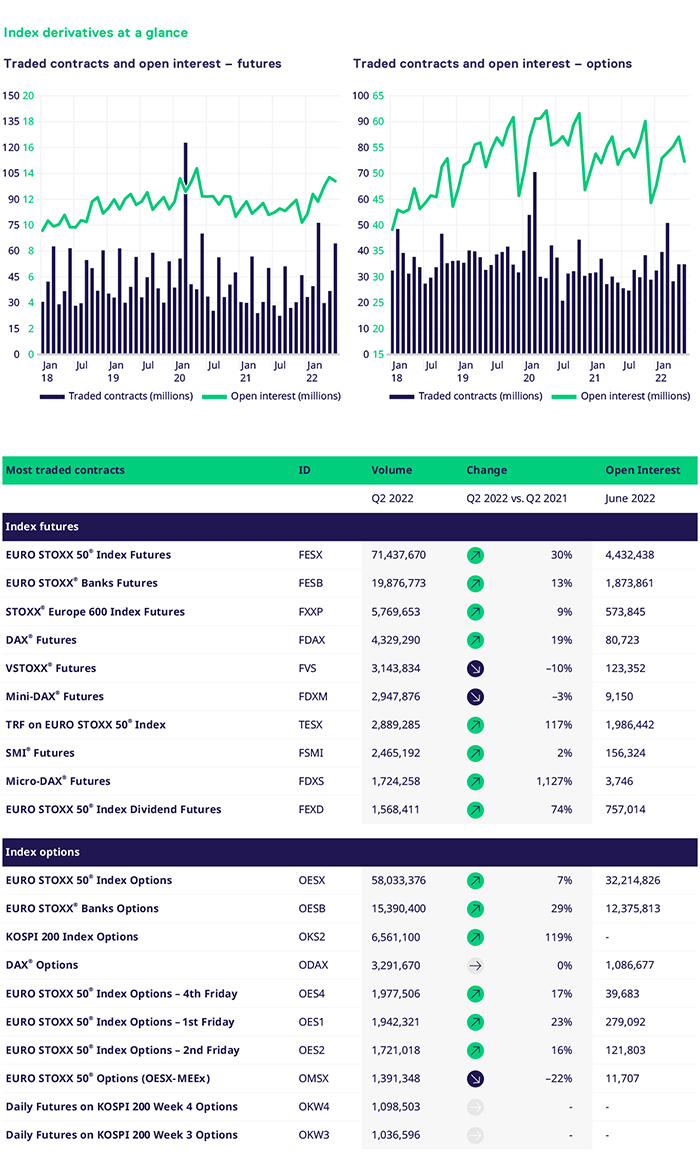

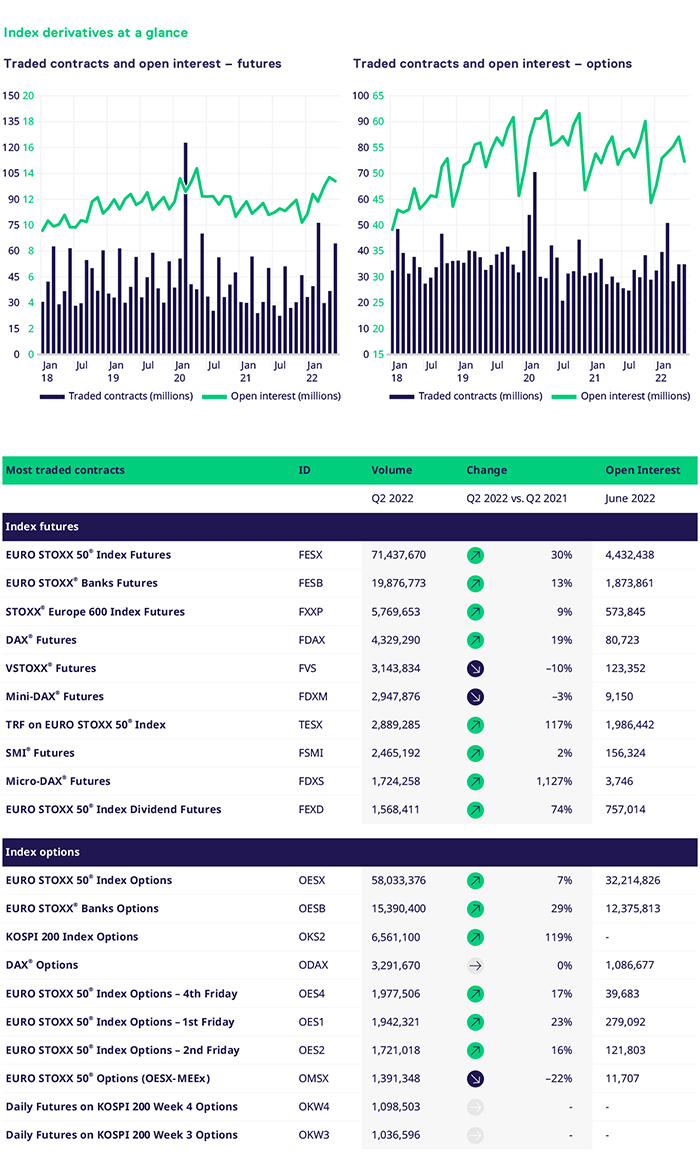

The volatility stemming from the fast regime shift has provided strong demand for derivative hedging at Eurex, which has fed through to robust volumes in the top 10 benchmark futures products: EURO STOXX 50®, Banks sector, STOXX® Europe 600, DAX® and Micro-DAX®, TRF, EURO STOXX 50® dividends, MSCI World, MSCI EM Asia and KOSPI 200. The remaining product suite has seen similar good levels of activity with highlights in some newer products: MSCI China futures and EURO STOXX 50® ESG options.

Several exciting new listings and new functionality has been rolled-out in Q2 to support end-client demand: Bank sector dividend options, Trade-at-Market for Variance Futures, Inter-product spread for EURO STOXX 50® Index Quanto Futures, options on ESG iShares ETFs and the Thematic index futures. As we move into the year's second half, we will focus efforts on those core new product solutions driven by customer interests.

The market feels ready to breathe a collective sigh of relief that the worst of the bursting bubble is in the past. However, this new macro-economic regime may reflect that those higher levels of realized asset volatility are here to stay into Q3. If this is to be the scenario, we can expect derivative hedges to be rolled forward on Eurex and new trading opportunities will emerge for those able to take advantage and speculate on whether the QT does or does not tip the global economy into a recession.