1. Introduction

This circular contains information with respect to Eurex Clearing’s service offering and corresponding amendments to the Clearing Conditions of Eurex Clearing AG (Clearing Conditions) and Price List of Eurex Clearing AG (Price List) regarding the following topics:

A. Introduction of Micro-Options on the DAX® index,

B. Delisting of futures and options on the MDAX® index.

Effective date: 19 December 2022

2. Required action

There is no required action for the participants.

3. Details

A. Introduction of Micro-Options on the DAX® index

Effective 19 December 2022, Eurex Clearing will offer clearing services for Micro-Options on the DAX® index introduced at Eurex Deutschland.

In this context, the following measures will apply effective 19 December 2022:

- Amendments to the Clearing Conditions of Eurex Clearing (Clearing Conditions) regarding the inclusion of Micro-Options on the DAX® index,

- Amendments to the Price List of Eurex Clearing (Price List) regarding the inclusion of Micro-Options on the DAX® index.

Please refer to Eurex circular 103/22 for detailed trading-related information as well as the amendments of the relevant Rules and Regulations of Eurex Deutschland.

Production start: 19 December 2022

a. Product overview

Micro-Options on the DAX® Index differ from the existing DAX® index options (ODAX) in terms of contract size and offered terms only. The value of one index point is EUR 1, while the maximum term is 12 months.

b. Contract specifications

For the detailed contract specifications, please refer to Eurex circular 103/22.

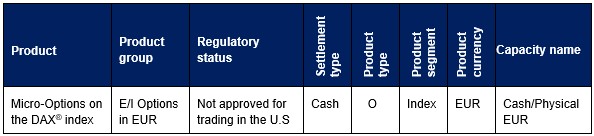

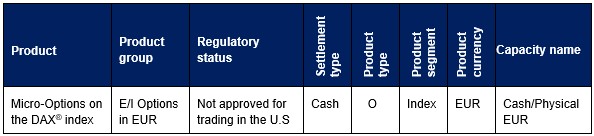

c. Product group

The product group of the new product is as follows:

d. Transaction fees

The fees for the new product can be retrieved from the updated sections of the Price List, as outlined in Attachment 2.

e. Risk parameters

Margins for the new products are calculated in Prisma. For the risk parameters of the new products, please refer to the Eurex Clearing website www.eurex.com/ec-en/ under the link:

Services > Risk parameters

f. Amendments to the legal framework of Eurex Clearing AG

The following provisions will be amended as outlined in the attachments:

- Chapter II Part 3 Number 3.4.3 of the Clearing Conditions

- Numbers 3.1 and 3.7 of the Price List

As of the effective date, the full versions of the amended Clearing Conditions and Price List will be available for download on the Eurex Clearing website under the following link:

Rules & Regs > Eurex Clearing Rules and Regulations

B. Discontinuation of clearing services for futures and options on the MDAX® index

In conjunction with the decision taken by the Management Board of Eurex Deutschland to delist the futures and options on the MDAX® index (F2MX/O2MX), Eurex Clearing will discontinue the clearing services for these products with effect from 19 December 2022.

To reflect the decision in the legal framework of Eurex Clearing AG, the following provisions will be amended as outlined in Attachments 1 and 2:

- Chapter II Part 2 Number 2.4.2 and Part 3 Number 3.4.3 of the Clearing Conditions

- Numbers 3.1, 3.3, 3.4 and 3.7 of the Price List

The amendments to the legal framework of Eurex Clearing AG published by this circular are deemed accepted by each affected contractual party of Eurex Clearing AG, unless the respective contractual party objects by written notice to Eurex Clearing AG prior to the relevant effective date(s) as stipulated in this circular. In case of an objection by the respective contractual party pursuant the preceding sentence, Eurex Clearing AG is entitled to terminate the respective contract (including a Clearing Agreement, if applicable). Instead of submitting an objection, the respective contractual party may submit in writing to Eurex Clearing AG comments to any amendments of the legal framework of Eurex Clearing AG within the first 10 Business Days after the publication of the amendments. Eurex Clearing AG shall assess whether these comments prevent the published amendments from becoming effective taking into account the interests of Eurex Clearing AG and all contractual parties.

Unless the context requires otherwise, terms used and not otherwise defined in this circular shall have the meaning ascribed to them in the Clearing Conditions or FCM Clearing Conditions of Eurex Clearing AG, as applicable.

Attachments:

- 1 – Updated sections of the Clearing Conditions of Eurex Clearing AG

- 2 – Updated sections of the Price List of Eurex Clearing AG

Further information

Recipients: | | All Clearing Members, ISA Direct Clearing Members, Disclosed Direct Clients, FCM Clearing Members of Eurex Clearing AG, vendors and other affected contractual parties |

Target groups: | | Front Office/Trading, Middle + Back Office, IT/System Administration, Auditing/Security Coordination |

Related circular: | | Eurex circular 103/22 |

Contact: | | client.services@eurex.com |

Web: | | www.eurex.com/ec-en/ |

Authorized by: | | Jens Janka |